TPR data strategy: Transforming our data for better saver outcomes

This strategy is part of our overarching digital, data and technology (DDaT) strategy, which sets out a collaborative and adaptive five-year plan to drive adoption of the latest technologies and standards for data.

- TPR Data strategy

PDF 456KB, 20 page(s) - Published: March 2025

Our data strategy at a glance

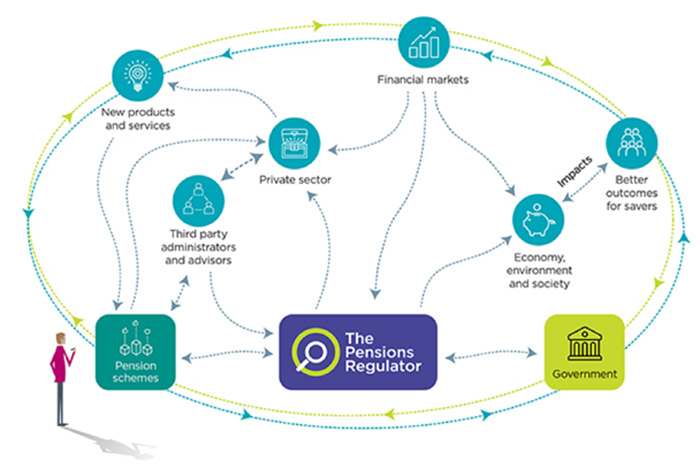

An ecosystem with less friction will reduce burden on pension schemes, enable effective market competition and benefit savers through innovation. While this document focuses on the data elements of the overarching DDaT strategy, it is important to note that it fits within a wider programme that we hope will transform the way both we at The Pensions Regulator (TPR) and the industry operate to drive innovation and benefit savers.

The pensions system is undergoing radical change with greater data sharing and transparency, creating new opportunities for savers and the industry.

Savers expect their financial needs to be met, their data to be accessible, and their pension schemes to be transparent and accountable. Good, modern investment and governance decisions require high-quality, fully digitised data to avoid inconsistencies, increased costs and security risks.

Artificial intelligence (AI) is also predicted to reshape financial markets and the pensions landscape, introducing new opportunities and risks.

In response, we will be focusing on three key areas:

- Building strong foundations by implementing data principles, developing forward-thinking data professionals and advocating for open standards for data to collect, analyse, and interpret high-quality data for better decision-making.

- Taking a wider data approach and reducing regulatory burden by creating an internal data marketplace that links to the government’s National Data Library and the wider external data ecosystem.

- Focusing on adding value by making sure all the data we collect is directly related to good saver outcomes and supports efficient and effective regulation, competition and industry innovation.

Introduction

The pensions system stands on the brink of radical transformation. With greater data-sharing improvements around transparency and technology, there are new opportunities emerging for us, savers and the industry. These changes promise to enhance regulatory compliance, foster innovation, and improve the overall effectiveness of the pensions landscape.

Who this strategy is for

In today’s data-driven world, it is important for people at all levels within all organisations to understand the power of data. This strategy is for data professionals and non-data people alike. It includes scheme administrators, trustees, anyone involved in managing pension schemes, and us at TPR. It provides an overview of our vision for the coming years, outlining expected changes at TPR and how these will affect you and how you work with us.

Where we want to get to

Data is growing exponentially, and our industry is no exception. Artificial intelligence (AI) is poised to reshape financial markets and the pensions landscape, introducing new opportunities and risks.

Artificial intelligence involves developing computer systems to perform tasks requiring human intelligence, like perception, recognition, decision-making and translation. It uses machine learning algorithms to identify patterns in data.

At the broadest level, we want savers to receive value for money throughout their savings journey and into retirement. Empowered by technology, savers expect their financial needs to be met, their data to be appropriately accessible, and their pension schemes and providers to be transparent and accountable. Just as people have benefited from the ease of open banking and modern mobile technology, we aim to see similar benefits in pensions, where savers can easily access information about their pension savings and trust the reliability and accuracy of the data.

At a more detailed level at TPR, as AI and data science advance rapidly, we need to make sure we keep pace, finding skilled data professionals, bridging skills gaps, and fostering continuous learning around data. We want to expand our data platforms to manage larger datasets, while modernising our data collection and publishing methods.

As a regulator, our role includes understanding individual scheme performance, monitoring investment risk strategies, and evaluating the overall risk picture and its impact on specific groups of savers. We need more data to meet our regulatory duties, and industry needs more data to demonstrate regulatory compliance, enhance transparency, support digital transformation, and enable better decision-making for the benefit of savers. We need to ensure the data is properly joined up, searchable, and provides value, while balancing any potential burdens.

What we’re going to do

Build strong foundations – Good investment and governance decisions require good quality, fully digitised data. Some employers, schemes and their administrators are yet to fully digitise their records and processes. Poor data quality leads to inconsistencies, increased costs, and security risks. Isolated data storage in silos hinders analysis and decision-making, while managing and protecting vast amounts of data, especially sensitive information, becomes increasingly complex.

There are changes on the horizon. With the arrival of pensions dashboards, and as schemes become fewer and larger, the standards required for data including quality, management, and safety grow increasingly more important due to the potential impacts of failure. Open standards for data will help us more easily collect, analyse, and interpret high-quality data for better decision-making. Data skills are more important than ever. We are working collectively with trustees and the largest administrators to understand their issues, help raise standards and mitigate systemic risks.

Take a wider data approach – Advances in technology have revolutionised the way we share and exchange data, making it significantly easier for industry and government to collaborate or regulate, enabling better information sharing. As government creates the National Data Library, making it easier to find and reuse data across public sector organisations, we will create an internal data ‘marketplace’ where our staff can access relevant data from one central location. This will allow our data to feed into the National Data Library and the wider ecosystem. By updating and improving our data processes and controls, and sharing data more efficiently and effectively, we aim to reduce the burden on schemes.

Focus on adding value – Having the right, good quality data is fundamental to understanding trends and predicting the future to derive value from the data. This is essential to enhance regulatory compliance, foster innovation and improve the overall pensions landscape. We are changing our ways of working while ensuring we are focused on saver outcomes. The evolution of this strategy will be key to supporting our future way of operating, as well as driving change.

We must be ready to embrace, adapt, innovate and lead in raising standards across all scheme types, ensuring clear, accessible, and reliable pensions data that meets savers’ changing needs.

Our data strategy for industry

Our corporate plan sets out three pillars: that we will protect savers’ money, enhance the pensions system, and innovate in savers’ interests. As laid out in our DDaT strategy, this translates for industry as follows:

- Reduce unnecessary regulatory burden and protect savers’ money.

- Facilitate effective market competition.

- Benefit savers through industry innovation.

To achieve these objectives, we want to put TPR as a key enabler of the pensions data ecosystem, advocating for open standards for data.

Open standards for data are simple rules that make it easy to share and use data from different places. Having them would enable us to collect, analyse and interpret high-quality pensions data from new and existing sources, allowing us to make better evidence-based decisions and understand changing dynamics in the pensions landscape. By modernising how we collect and make use of our data, we would reduce the burden on employers, schemes and their administrators, advisers and trustees.

The move to open standards would also provide an opportunity for effective competition and innovation that can benefit savers. This would enable us to understand the role pensions play in the wider financial landscape and the status of individual schemes’ performance against their peers. Savers would benefit from increased transparency, product provision and a competitive dynamic market, helping them to make better and more informed retirement decisions.

We will change how we work over the next five years by focusing on three key development areas.

- Implementing strong data principles and developing forward-thinking data professionals.

- Creating an internal data marketplace that links to the external data ecosystem, enabling us to make the most effective use of all our data and reduce regulatory burden.

- Ensuring that the value of data is focused on saver outcomes.

1. Data principles and data professionals

Empowered and forward-thinking data professionals are key to maximising the use of data, both within TPR and across the wider pension industry, ensuring we all build solid foundations to work from.

What we are planning

We are implementing a series of data principles to set high expectations for data management and effective data governance. We will then share and demonstrate our ways of working across industry with the aim of establishing a baseline for good practice.

Our data principles

- We value our data.

- We design data with users in mind.

- We secure and protect our data.

- We care for our data.

- We make sure our data is accessible and shared, where appropriate.

- We enable trust in our data.

- We make sure our data is easy to find.

- We drive the innovative use of data.

Establishing an internal data professionals community, increasing collaboration across different skill bases, and empowering our forward-thinking people will underpin our transformation.

Some specific initiatives include the following:

- Aligning roles and responsibilities to the relevant parts of our organisation, collaborating between teams and streamlining controls.

- Creating a data management function to handle a broader range of data.

- Working with our policy and digital teams to design modern data collection and exchange methods. We want to move away from form-based data entry to Application Programming Interface (API)-based data ingestion.

- Ensuring our data professionals can use agile solutions and AI technologies to deliver new insights and trends, and to focus on more strategic and analytical work, thereby increasing overall productivity.

An Application Programming Interface is a set of rules and protocols that lets different software applications talk to each other and share information easily.

Agile is a way to manage projects that focuses on working in small steps, collaborating with others, and being flexible to changes.

We will extend our data professional community to collaborate with industry to bring in best practice and good innovation ideas. This will help us to implement several further initiatives:

- Establishing a set of data taxonomies and standards for open data exchange.

- Explore moving from a system where data is sent automatically (push-based) to one where data is requested as needed (pull-based). This can make retrieving data more efficient and responsive and could lower the burden of reporting for schemes.

- Collaborating with industry and sharing best practice to help facilitate the change in our professions while maintaining existing expertise around saver and scheme financial outcomes and risk.

- Setting up a working group with industry experts to help the pensions industry improve its use of digital tools, data and technology, unlocking its full potential.

- Bringing together pension and technology experts, along with professionals from other fields, to design a framework for responsible innovation in pensions. This collaboration will help share ideas and speed up impactful innovations.

- Establishing an AI advisory council, comprised of TPR staff and external experts, to oversee the ethical use of AI technologies.

2. An internal data marketplace and the wider data ecosystem

Using standardised data that flows across the wider ecosystem will reduce regulatory burden and encourage innovation and transparency in the pensions market for the benefit of savers.

What we are planning

We are first taking stock of all the data we currently have, ensuring it is well managed and easy to locate and use. We will then modernise how we collect, use, and share it.

Some specific initiatives include the following:

- Creating an internal data marketplace (a central place for people in TPR to easily find, access and share data).

- Connecting and feeding into the cross-government National Data Library and the wider ecosystem by publishing data where appropriate.

- Collaborating with government departments and partners on open standards for data to improve data flow. We want to share the data we can, with the aim of people just providing it to us once.

- Improving our data platform to enable a radical overhaul of our data collection and exchange mechanisms, using modern API-based methods to securely exchange data.

- Using our improved data platform to analyse different data sources including large volumes of market data, near real time where needed, and enhancing our horizon scanning and risk analysis.

- Performing cohort analysis to understand market impacts on individual savers differently, and developing policies for fairer outcomes.

We are also working on our 'master data' so that:

- scheme and employer data is accurate, externally verified where possible and joined up, eliminating duplication and inaccuracies

- contacts and companies we interact with have up-to-date details so we can analyse our interactions, take a risk-based approach, and focus on the right areas

- staff and other internal data are accurate and flow effectively

Master data is the core data that is essential for operations in a business.

Data value for better saver outcomes

We want the data we collect and use to support our regulatory functions and industry innovation. We are working with industry to drive that innovation to enhance all savers’ interests and potentially provide new commercial opportunities.

What we are planning

Our internal expert analysts and analytics groups are collaborating to make full use of our new internal data marketplace, sharing skills to better use AI, data science, actuarial and risk models.

Some specific initiatives include the following:

- Increasing the data proficiency for our internal teams to make the most of new and developing analytical capabilities.

- Embedding knowledge management and the effective use of our unstructured document data across case teams, legal professionals, intelligence and others.

- Understanding and maximising our data quality, which will allow us to set standards and demand high-quality data from ourselves and others.

- Alongside existing scheme returns, recovery plans and HMRC PAYE data that we already collect, we will bring in additional market data, including scheme asset allocation, investment strategy details, and frequent valuation or market pricing data.

- Accelerating our AI journey by exploring appropriate ways to enhance our capabilities and drive innovation.

We are improving our ability to experiment with AI, allowing us to innovate both within our organisation and in collaboration with industry. This will include creating an AI sandbox as part of our broader regulatory sandbox strategy.

A sandbox is a safe, isolated environment where you can test and experiment with software or data without affecting the rest of your system.

What this means for you

We want to capitalise on initiatives like open finance in our industry, allowing savers to better manage their pensions by integrating various financial services and fostering greater engagement with their retirement planning.

We want the pensions industry to adopt good data practice, embrace the modern data ecosystem, understand the wider benefits of sharing data effectively, and collaborate to help define how this can work for schemes, employers, and savers.

Bad data (information that is incorrect, incomplete, outdated or poorly formatted) drives extra costs. For defined benefit schemes, these costs make them less attractive to buy out. For all schemes, pensions dashboards are raising expectations from savers that need to be met. We recognise the different lifecycles of defined contribution and defined benefit schemes and how this impacts your data. But at the heart of this, all schemes require good data to ensure they are effective and efficient.

Using our data in a better way will improve how we work, provide guidance, direction and encourage innovation. We need the pensions industry to engage to help us take this forward.

The impacts of our plans are as follows.

Reducing unnecessary regulatory burden

With strong principles and a community of experienced data professionals working closer together, we will make better use of data we already have, reducing the need to ask for more information unnecessarily.

Whatever your role, you can have confidence that we are using data and AI effectively, efficiently, and ethically to target our regulation to best protect saver outcomes. We are expecting the industry to digitise personal member data currently in paper form and extract it into databases. We will work with industry to set clear standards for data management and record-keeping, and clear expectations for data skills and fluency across the industry, as well as working together on unlocking the potential of AI.

If you are an employer, trustee, or adviser, the way we collect data from you will change. We will introduce standards such as standardised data shared through APIs from different scheme systems. As we start to capture and analyse data at a more granular level via modern methods, it will reduce the burden to summarise information for us and reduce the effort in manually transferring data.

Our investment in new tools will improve our modelling, analysis, and forecasting. This means we will record and analyse interactions with you more effectively as part of our regulatory oversight and respond more quickly to non-compliance. We are committed to working with other government agencies to move to a model where we ask for data only once, reducing regulatory burden and supporting industry. We will publish our data where possible to enable you to build on our datasets and gain additional insight.

We’re tapping into cross-governmental initiatives like Essential Shared Data Assets and utilising the Office for National Statistics’ Integrated Data Service to ensure our policies are designed with the best information available. If you are one of our direct government partners like the Money and Pensions Service (MaPS) or the Financial Conduct Authority, we will continue working with you to ensure that we can move to modern data-sharing technologies with the appropriate governance.

If you are an employer, pension scheme, trustee or adviser, our teams will have new tools to analyse trends and predict risk. We will have more nuanced conversations with schemes about their investment decisions and risk controls, enabling proactive regulatory interventions. Using our data models and AI tools, we will augment regulatory activity, analyse scheme investment strategies, and flag high-risk strategies.

If you are a saver, we will enhance the protection of your money by using significantly more market data for horizon scanning and market risk assessment. We will prioritise enforcement and intervention activities on higher-risk employers and schemes. We will start to measure our own performance based on your outcomes.

Enabling effective market competition

We will actively encourage partnerships across the pension tech industries to share insights and develop integrated solutions. We will help develop standardised data structures and taxonomies for use across the industry, benefiting employers, pension scheme providers, trustees, and their advisers.

If you are a partner, we will have improved standardised ways of securely sharing data with you to improve collaboration outcomes. If you are an employer, pension scheme, trustee, adviser, or administrator, we want to ensure that savers can see, in plain numbers, what they’re getting for their money. We will engage with you to develop the policy framework to enable improved transparency. This additional transparency will enable employers to make better decisions, drive competition among providers to improve performance, and enhance market efficiency.

We want to contribute to the development and alignment of international standards for pensions data that prioritise transparency and security, enabling effective competition and good decision-making for savers. We will continue to actively collaborate with MaPS, supporting pensions dashboards for full transparency of financial health for savers.

Benefiting savers through industry innovation

We believe the changes we make because of our strategy will positively affect millions of savers across the £2 trillion pensions landscape. We intend to keep building our teams of experienced data professionals and innovative thinkers to push forward ideas and processes for better retirement outcomes.

AI is helping businesses run more efficiently and with better insight. Generative AI-enabled tools will provide access to regulatory expertise in a completely radical way. By collecting and publishing data to the overall data ecosystem using open standards, we will support third-party innovation, which could lead to new business opportunities for a thriving pensions system.

If you are a market entrant or pensions technology provider, we want to support the development and adoption of new technologies that enhance the transparency and efficiency of pension services. We will work with industry to generate a safe space to collaborate with us on data and AI.

We will encourage the development of pension products that prioritise environmental sustainability and societal impact. We will develop a framework for ethical technology and data use that all pension providers can adopt. Better use of data will enable us to drive innovative approaches to improve saver outcomes, leading to better and more personalised help and products for savers.

Delivering our plan

The external environment is volatile, uncertain and fast-moving, particularly in the world of data. This demands a flexible, adaptive approach to strategy development, which allows us to pivot and prepare for different eventualities.

Elements of our strategy and the data ecosystem will develop at different paces, allowing us to adjust our ambitions as needed.

We have already started delivering our plan, and industry will notice a difference in how we interact with them around data. As part of our DDaT strategy, we commit to working in the open, sharing our progress via industry engagement and reporting on our key measures of success in our Annual Report and Accounts.

We will engage with trustees, pensions professionals and schemes to get their feedback and ideas. We will connect with established industry and government working groups, and also establish our own where needed, to develop and implement common standards. We will work with the tech industry from across sectors and countries to learn lessons and move the industry in the UK forward. We have also invited some of the largest administrators to collaborate with us to understand how they operate and mitigate systemic risks.

With pensions dashboards no longer on the distant horizon, it is now time for schemes to get their houses in order. We will be writing to all chairs of trustees several times in the year leading up to their dashboard’s connection date, setting out the clear actions they must take. We urge you to think of dashboards as an exciting opportunity for innovation, and to use it as a springboard to start getting to grips with your data.

We’re imagining a future where data has acted as a catalyst for pensions innovation, transparency and regulatory effectiveness, benefiting savers and enabling them to transform the way they plan for retirement. In this future, employers and trustees enjoy seamless data management and effortless compliance, slashing administrative burdens and costs. A dynamic, collaborative approach ignites innovation, fuels competition and ultimately delivers the best outcomes for millions of savers.

We hope you will join us on this journey, be a part of this transformative movement, and help shape the future of pensions by collaborating with us.