Newburgh Engineering Co Ltd Pension and Assurance Scheme – Regulatory intervention report

In this case the sponsoring employer of a defined benefit (DB) scheme was involved in a series of corporate restructurings whereby significant assets (£16 million) were transferred to other group entities.

Ultimately the employer went into administration and was unable to support its DB scheme. The Pensions Regulator (TPR) used its anti-avoidance functions against third parties, seeking to mitigate losses to members and the Pension Protection Fund (PPF) caused by avoidance activity. TPR’s settlement resulted in £3.52 million returned to the pension scheme. Whilst less than the section 75 debt (£8.84 million), this represented all the targets’ cash assets and around 80% of their estimated available assets.

This case demonstrates that we will investigate corporate transactions and restructurings which affect schemes of all sizes and when it appears that proper mitigation has not been considered for the scheme, our anti-avoidance powers may be engaged. We will also consider reasonable settlement offers which help us to meet our statutory objectives of acting in the interests of scheme members and the PPF, while saving considerable costs and resource for all parties involved. In some circumstances this may include holding settlement discussions with third parties as well as the PPF and the trustee.

On this page

Case summary

TPR facilitated a multi-stakeholder global settlement after issuing warning notices proposing the use of our financial support direction (FSD) power against six entities within a corporate group. The settlement includes:

- the six corporate targets of our warning notice

- the PPF

- the scheme trustee

- the sponsoring employer (in liquidation) and

- another entity within the targets’ group

The case was settled in December 2022, meaning that our Determinations Panel did not make any decisions in relation to the events described in this report. The targets settled this matter with no admission of liability.

As part of the settlement the targets of our regulatory action paid £3.52 million to the pension scheme which has now transferred to the PPF.

Background

Newburgh Engineering Co Limited (NEC) is the statutory employer of a small DB pension scheme, Newburgh Engineering Co Ltd Pension and Assurance Scheme, which has around 100 members. The scheme had a Part 31 funding deficit of £2.32 million as at the last triennial valuation on 31 March 2014 (prior to the employer’s insolvency) and a section 752 deficit of £8.84 million. The employer went into administration in October 2018 and the scheme entered into the PPF assessment period. The employer later entered into creditors voluntary liquidation in January 2019.

The scheme was established to provide pension benefits for NEC employees. From 2005, parts of NEC’s business and most of its assets were transferred to other group entities, and therefore outside the reach of the scheme. No proper mitigation was given to either the employer or the scheme. The business and assets of NEC were fragmented among a wider corporate group (the IMS Group, which owned the employer and the targets), to the detriment of NEC and the scheme.

The targets of our regulatory action were:

- Newburgh Holdings Limited (NHL)

- Hope Valley Industrial Limited (HVIL)3

- Hope Valley Residential Limited (HVRL)

- Hope Valley Industrial Holdings Limited (HVIHL)

- Hope Valley Residential Holdings Limited (HVRHL)

- Hope Valley Holdings Limited (HVHL)

At all material times the IMS Group was controlled by a small group of individuals holding multiple concurrent roles within the group, including acting as directors of NEC and the target entities. These individuals, including Vince Middleton as common director of all the targets and NEC, acted to further the objective of protecting and enhancing the value of the assets of the group. The IMS Group was ultimately owned by the Isaac Middleton Settlement Trust (the IMS Trust), a family discretionary trust with over 100 beneficiaries.

A series of corporate restructurings took place in 2005, 2014 and 2017 before the employer’s entry into administration on 19 October 2018. These restructurings involved the incorporation of new IMS Group companies, including the targets, and the transfer of the employer’s assets to them via asset transfers to other group entities. The employer also provided significant financial support to other IMS Group entities which meant that the targets could preserve their own assets. If the employer had not provided this financial support to the wider IMS Group, the targets would have had to provide it.

In total the IMS Group, including the targets, received financial support worth £16.68 million through the restructurings of the employer’s assets. No proper mitigation was given to NEC or the scheme in return. Had these funds been made available by the employer to the trustees of the scheme, it is likely that the scheme trustees could have secured a buyout of the scheme’s liabilities with an insurer. Instead, the scheme suffered significant detriment between 2005 to 2018 while the targets collectively received significant benefits from NEC. Over this time the covenant of NEC was eroded to the point that it has now become insolvent and therefore unable to support the scheme.

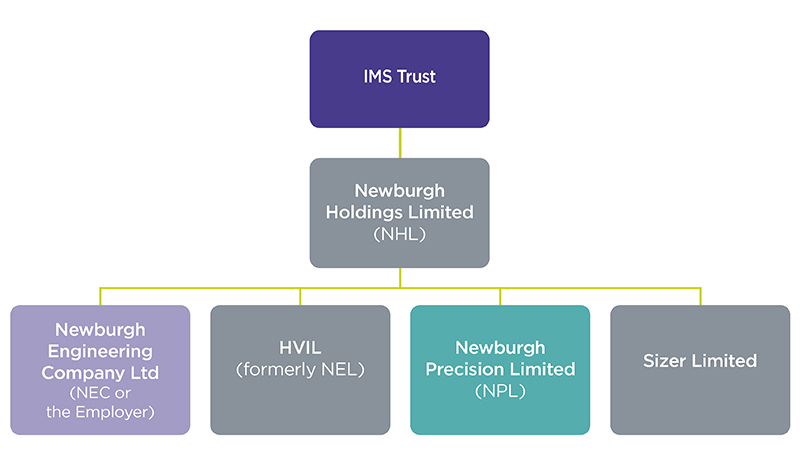

Figure 1: NEC corporate structure pre-2005 restructuring

- 75% shareholding held by IMS Trust in NEC (remaining 25% shares are held by Middleton family members).

Figure 2: NEC corporate structure post-2005 restructuring

- 75% shareholding in NHL held by IMS Trust (the remaining 25% of shares in NHL are held by Middleton family members).

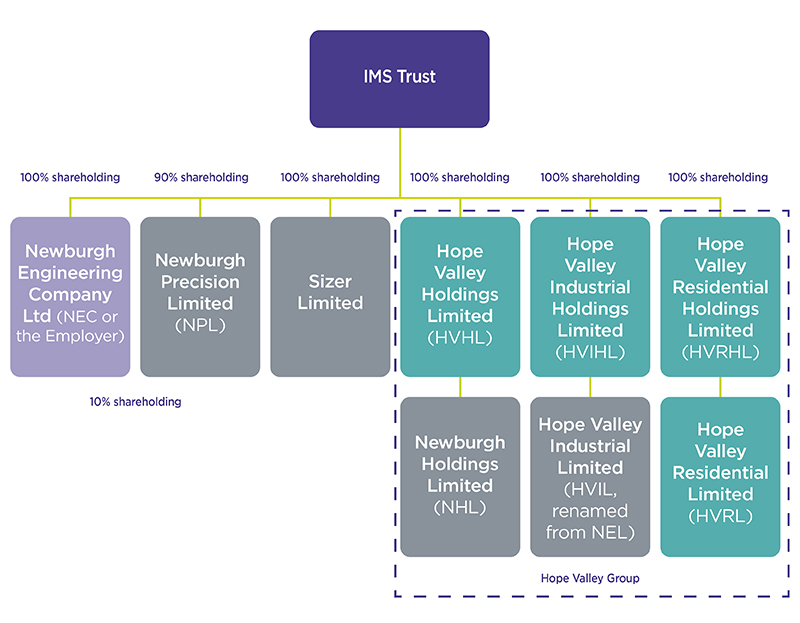

Figure 3: corporate structure post-2014 restructuring

- 100% shareholding held by IMS Trust as of 2015. Prior to this Middleton family members held 25% of the shares in NHL which were bought out between 2014 to 2015 for £2.1 million.

- Sizer Limited was incorporated on 01 December 2009.

- Firechill Limited was incorporated on 14 October 2009 (originally 49% owned by NEC from 2010, then 50.5% owned from 12 July 2011 until dissolved on 05 August 2015). Audit CNC Limited was incorporated on 26 September 2011 (80% owned by NEC until interest was sold on 01 August 2015).

Figure 4: corporate structure of the ‘group’ post-2017 restructuring

- As part of the 2017 restructuring, the employer (NEC), NPL and Sizer became direct subsidiaries of the IMS Trust. The Hope Valley Group is also 100% owned by the IMS Trust and controlled by the IMS Trustee.

- Properties and investments once held directly by NHL and via its subsidiary HVIL were transferred out to HVRL as part of the restructuring.

- As at 31 March 2014 the NHL group held property valued at £11.26 million and consolidated net assets were £10.3 million, whilst NHL itself had net assets of £5.7 million. However, by 31 March 2017, the investment holdings of NHL (by this time a subsidiary of HVHL with no group subsidiaries of its own) had reduced to nil and net assets had reduced to £61,000.

- All companies owned by the IMS Trust (including the new Hope Valley Group) continue to share Vince Middleton as a common director after the 2017 restructuring.

Summary of benefits received by the targets from NEC

The benefits received by the IMS Group (including the targets) from NEC between 2005 and 2018 can be broadly categorised as follows.

Direct benefits received from property transfer in 2005

A dividend worth £5.67 million was issued by NEC to the target NHL on 9 December 2005. This was satisfied by the transfer of property assets with a market value of £5.81 million from NEC to the target HVIL - a sister company of NEC. Subsequently, between 2005 and 2018, transfers of these former property assets of NEC were made among the wider group of targets. In February 2017 the other four targets (HVRL, HVIHL, HVRHL and HVHL) were incorporated as part of the IMS Group to accommodate some of these former property assets of NEC. The assets that were transferred in 2005 were either sold later by the targets (for a total consideration of £7.96 million) or retained (with a book value at the time of issuing the warning notice of £1.13 million). The total value of benefits ultimately received by the targets as a result of the property transfer from NEC to HVIL in 2005 was therefore in the region of £9.10 million.4

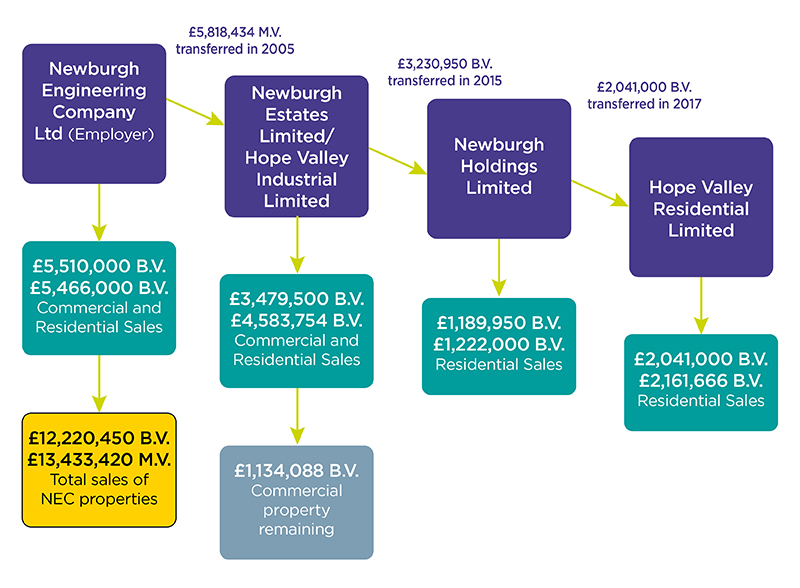

Figure 5: transfer of property assets between the targets and their onward sales to third parties

Transfer and sales figures in book value (B.V) and market value (M.V) following the property transfer in 2005 from the employer (NEC) to HVIL (formerly NEL).

- Includes £5.67 million dividend in specie plus £140,000 value subsequently assigned to the site known as Newburgh Works.

Other indirect benefits received by the targets

In addition, NEC provided ongoing financial support in the form of loans to other IMS Group entities such as NPL, Sizer Limited, Firechill Limited and Audit CNC Limited, most of which were supporting investments that were known by the IMS Group to be speculative and high risk. Approximately £7.58 million of loans provided by NEC to these IMS Group companies remained unpaid at the time of issue of the warning notice.

The IMS Group’s intention appears to have been to generate businesses which could be sold to maximise the assets of the IMS Trust. However, these entities are now either insolvent or have been sold out of the IMS for limited sums, and there are negligible prospects of NEC recovering any monies from them.

Had NEC not provided financial support to these other IMS Group entities, it is likely that the targets themselves would have had to provide this financial support, probably using NEC’s former assets that were transferred out to HVIL in 2005. By using NEC to provide this support instead, the IMS Group did not use assets of, or later owned by, the targets. The targets were therefore protected and benefited from NEC’s support for other group entities.

Figure 6: table showing total value of financial support provided by the Employer (NEC) to the IMS Group including the targets

This includes assets transferred from NEC to NHL/HVIL (formerly NEL) in December 2005 and loans (with balances unpaid) advanced by NEC to NPL, Sizer, Firechill and Audit CNC.

| Recipient legal entity | Summary of value transferred | £ (million) | Notes | |

|---|---|---|---|---|

| 1 | NHL/NEL | Property transfer from NEC to NHL/NEL in 2005 | 9.10 | £13.433 million market value of sales plus £1.134 million book value remaining. Minus market value sales from NEC (£5.18 million Rotherham sale, recorded below, and £0.286 million Pennine Cottage) |

| 2 | NPL | Demerger of NEC and NPL in 2014 - working capital support and intercompany loans | 5.82 | Intercompany loan balance only |

| 3 | Sizer | Working capital support | 0.98 | Intercompany loan balance only |

| 4 | Firechill | Working capital support | 0.35 | Intercompany loan balance only |

| 5 | Audit CNC | Working capital support | 0.48 | Intercompany loan balance only |

| Total of lines 2, 3, 4 and 5 | 7.64 | NEC support to group companies NPL, Sizer, Firechill and Audit | ||

| Total | 16.73 | Value transferred from NEC to IMS group and targets | ||

The rationale for restructuring NEC’s assets

In implementing the restructurings of NEC’s assets, the directors of NEC and the targets, of which Vince Middleton was a common director, were guided by the management objective set by the IMS Group. This was, in their own words, to deliver the maximum funds to the trust in the most efficient manner possible with a view to the trust holding no assets and being in a position to wind up between April 2021 and December 2024. No consideration appears to have been given to providing proper mitigation to NEC or the scheme for these transactions.

The repeated transfers of NEC’s assets to other IMS Group entities appears to have been part of an orchestrated plan by the directors of NHL and the IMS Group to insulate NEC’s (former) assets from claims against NEC (including from the scheme) and thereby protect their value and the interests of the IMS Trust as shareholders. Irrespective of their intention, it was undoubtedly the effect of the transactions.

For example, an offer letter to the shareholders in respect of the property asset transfer in 2005 from NEC to HVIL describes its primary objective as being “to insulate the properties from the commercial risks, and thus protect the interests of the shareholders”. In particular, the directors considered “that the proposed reorganisation gives greater protection to the property assets from any claims against the company".

The purpose of a demerger of NEC’s business in 2014 was to make this element of NEC’s former trading business a “saleable entity in the future… free of the pension liability”. NEC was selected to provide ongoing financial support to other IMS Group entities “to proceed on the basis that the risk to [IMS Trust] beneficiaries was kept to a minimum". By using NEC to provide this support, the IMS Group did not use assets of (or later owned by) the targets which included NEC’s former assets now held by the targets. This appears to have been a deliberate strategy by the IMS Group.

In relation to a write-off of debt owed by NPL to NEC of £4.45 million in November 2017, it was recognised by the IMS Group that this would have a negative effect on NEC’s balance sheet. However, this issue does not appear to have been viewed by those controlling NEC as a concern, since it was concluded that the debt write-off would have “a neutral impact on the assets of the trust, as both [NEC and NPL] are owned by the trust". It appears that no consideration was given at the time to the impact of the debt write-off on NEC or its covenant to the scheme. Nor to the giving of proper mitigation to NEC or the scheme, or to alternative sources of finance within the group.

Summary of the financial benefit received by the targets from NEC

- HVIL - £5.818 million received directly from NEC in 2005

- NHL - £3.230 million contemporaneous book value received from HVIL in 2015, whose funds originated from NEC

- HVRL - £2.041 million contemporaneous book value received from NHL in 2017, whose funds originated from NEC via HVIL

- HVIHL - holds 100% of the shares and value in HVIL

- HVRHL - holds 100% of the shares and value in HVRL

- HVHL - £750,000 intercompany balance owed by HVIL, whose funds originated from NEC

Footnotes for this section

- [1] Every DB scheme is subject to a requirement under Part 3 of the Pensions Act 2004 that it must have sufficient and appropriate assets to cover its liabilities.

- [2] A debt due to the Scheme triggered under s.75 of the Pensions Act 1995 when the employer suffers an insolvency event at a time when the Scheme is in deficit.

- [3] Formerly Newburgh Engineering Limited (NEL).

- [4] This figures does not include an allowance for capital expenditure and capital gains tax, and therefore represents an estimate of the total value of benefits received from the property transfers.

Regulatory action

In March 2021 we issued warning notices seeking FSDs against the six targets. Our case was based on the significant detriment caused to the scheme during the period 2005 to 2018 while the targets (individually and as a group) received significant financial support from the employer. Over this time the covenant of the employer was eroded such that it ultimately went into insolvency and was unable to support the scheme, resulting in the members receiving reduced benefits.

On 17 December 2020 TPR obtained an undertaking from Mr Middleton on behalf of the directors of the targets and the IMS Trustees not to move assets from the targets or distribute any funds (other than for the normal running of the businesses) until 31 March 2021.

Following the issue of warning notices, Mr Middleton agreed to extend the duration of the original undertaking pending the conclusion of TPR’s regulatory proceedings, including the expiry of any appeals. This was to ensure that any FSDs issued by the Determinations Panel could be given effect in a way that resulted in financial support being received by the scheme. Any attempts made to move or distribute funds from the targets prior to the conclusion of the regulatory proceedings may have resulted in TPR initiating further anti-avoidance regulatory proceedings.

In view of the fact that the directors had previously declared an intention to seek to wind up the targets, undertakings were also given by Mr Middleton:

- that the directors would notify TPR immediately of the contact details of any relevant insolvency practitioner appointed in connection with a winding up of the targets

- to provide the insolvency practitioner with a copy of TPR’s warning notice

- to inform them of TPR’s intention to register a contingent claim in the winding up proceedings prior to the distribution of any assets from the targets

The targets responded to the warning notices in July 2021 and asked to discuss potential settlement options with us. We analysed the targets’ assets and in December 2021 and made a without prejudice settlement proposal to the targets to incentivise an early settlement. The targets’ counter proposal included a payment of £3.52 million into the scheme which represented all of their cash assets and around 80% of their estimated available assets. This was in exchange for full and final settlement of all claims relating to this matter against the targets and their former directors by both TPR, the joint liquidators of the sponsoring employer as well as by the joint liquidators of another entity within the corporate group which was not a target of our warning notice.

Outcome

In December 2022 we successfully reached a global settlement with the targets, the joint liquidators, the scheme trustee and the PPF. This resulted in £3.52 million being paid into the scheme which mitigated the financial impact of the scheme’s transfer into the PPF.

Timeline of events

| Date/period | Event |

|---|---|

| 13 August 2005 | The 2005 restructuring. NHL was established as an intermediate holding company for HVIL and NEC. Shareholdings in NEC were exchanged for an identical number of shares in NHL. |

| 8 December 2005 | NEC declared a dividend in specie of £5,678,434 to NHL paid by way of transfer to HVIL of all of the properties, land and buildings of NEC (except for the Rotherham site). HVIL issued shares to NHL in consideration for the receipt of properties. |

| 2009 to 2011 | Sizer and Audit CNC were created and NEC became controlling shareholder. |

| January to March 2014 | The 2014 restructuring. NPL was created as a wholly owned subsidiary of NHL. NEC transferred plant and equipment, stock and goodwill, with a book value of £2.6 million to NPL by way of intercompany loan, and grants NPL a lease to occupy the Rotherham site. |

| 8 October 2014 | Firechill wound up. NEC had written off £352,746 in loans to Firechill by this date. |

| 31 March 2015 | NHL’s accounts recorded that during the financial year HVIL has transferred to NHL property assets valued at around £4.6 million that were originally owned by NEC. Further loans of £730,000 are advanced in August 2015 and NEC borrowed funds from HVIL to enable it to advance this funding to NPL. NHL’s accounts recorded that during the financial year it has bought back some of the minority shareholdings in NHL from Middleton family members for around £1.07 million. NPL’s accounts recorded a significant loss of £1.2 million in its first full period of trading. |

| 1 August 2015 | NEC sold its 80% shareholding in Audit CNC and writes off £417,616 of debt. |

| 17 August 2015 | The 2015 Rotherham sale and leaseback transaction. NEC sold its commercial property in Rotherham to a third party for £5.180 million in a sale and leaseback transaction, primarily to enable it to use the sale proceeds to provide financial support to NPL. NPL entered into a lease agreement on the premises, with rental payments guaranteed by NEC. |

| 31 March 2016 | NPL’s accounts records that it made a loss of £2,131,382 for its second financial year of trading and its audit report notes uncertainty over the company’s ability to continue as a going concern. |

| 13 February 2017 | The 2017 restructuring. HVHL, HVIHL, HVRHL and HVRL were all incorporated. Following the restructuring NEC, NPL and Sizer became directly owned by the IMS Trust and so were separated from The Hope Valley Group which now held most of the Group’s assets. |

| 10 April 2017 | The issue of a loan by NEC to NPL to facilitate the purchase of NPL’s new machinery, funded by a loan from HVIL to NEC. |

| 30 November 2017 | The 2017 NPL debt write-off. NEC resolves to write off loans made to NPL with a value of £4.450 million. (In September 2018 NEC passes a resolution to subscribe for a “B” share in NPL as (retrospective) consideration for the 2017 NPL debt write-off). |

| 5 February 2018 | The trustees were informed that NEC was writing off around £5 million of NPL’s debt. |

| 2 July 2018 | A TPR enquiry was opened after the scheme's actuary informed TPR that the 2017 valuation would be submitted late due to the write off of £5 million of debt owed by NPL and that formal independent covenant advice was being obtained. Shortly after, 20-20 Trustees are also appointed to the scheme. |

| July 2018 | NEC paid around £400,000 in loan repayments to HVIL. |

| 9 October 2018 | The PPF raised concerns over previous inter-company transactions in view of the impending insolvency of NEC. |

| 12 October 2018 | TPR opened an avoidance investigation to investigate a series of intercompany transactions involving NEC and written off intercompany debts. |

| 19 October 2018 | NEC entered into administration and the scheme enters the PPF assessment period. A pre-pack sale of NEC’s business takes place. Certain assets are transferred to NECL, a new company owned by Vince Middleton. |

| 19 January 2019 | NPL entered into administration. |

| 24 January 2019 | NEC is moved from administration into creditors’ voluntary liquidation with new insolvency practitioners being appointed as the liquidators. |

| 4 April 2019 | Sizer entered into creditors voluntary liquidation owing NEC £982,000. |

| 20 March 2021 | TPR issues warning notices against the targets. |

| 30 July 2021 | The targets submitted representations to the warning notice and commenced without prejudice settlement communications. |

| 8 December 2022 | A global settlement agreement was reached between all parties involved. A sum of £3.525 million is received by the scheme trustee from the targets and TPR’s regulatory action ends. |