Estimated DB scheme universe funding splits and assets under management

Published: 27 January 2025.

Scope

We have been asked by the Department for Work and Pensions to provide estimates of defined benefit (DB) scheme assets and liabilities, number of schemes in deficit and in surplus as well as a breakdown of DB surpluses across the following different measures; technical provisions, low dependency and buyout together with the cumulative DB asset value by number of schemes (smallest to largest). This actuarial information is to inform private pension policy.

We have been asked to provide this at the most recent date, so for these purposes we are using the data on our systems on 30 September 2024, and a calculation date as at 30 September 2024. In respect of the low dependency funding basis we have assumed a discount rate set broadly equal to the gilt curve plus 0.5% per annum.

Further details regarding our low dependency basis and our calculations to estimate these liabilities and assets, together with other information regarding the data and methodology, are shown in the appendix.

Where the figures or graphs used in this report are used in any public domain or report, we request that we see and review the use of this actuarial information in draft form. We want to support government and industry to develop good policy and support innovation and we are happy to share our information to do this, but where (as in these circumstances) these are actuarial estimates we need to ensure they are clearly communicated.

Results

The tables below show estimated total number of members, schemes, total assets and liabilities and surplus or deficit in the DB universe as at 30 September 2024. They are split by funding level across the different bases ie technical provisions, low dependency and buyout. Asset and liability values are provided in £ billions (£bn).

Table 1: A summary of the overall aggregate funding position as at 30 September 2024

| Figures as at 30 September 2024 | Technical provisions | Low dependency | Buyout |

|---|---|---|---|

| Assets £billion | 1,240 | 1,240 | 1,240 |

| Liabilities £billion | 1,033 | 1,103 | 1,233 |

| (Deficit)/Surplus £billion | 207 | 137 | 7 |

| Aggregate funding level | 120% | 112% | 101% |

| Total number of schemes | 4,818 | 4,818 | 4,818 |

| Proportion schemes in surplus | 82% | 75% | 49% |

| Proportion of schemes in deficit | 18% | 25% | 51% |

When providing a breakdown of the DB funding universe, we have used funding levels in 5% ranges and applied a collar of 50% (and summed all of those below) and a cap at 140% (and summed all of those above). Rather than provide separate tables, we have therefore shown the breakdown by both surplus (those with a funding level of 100% and greater) and those in deficit (those with a funding level of lower than 100%).

For the table showing cumulative asset values, we have grouped these into buckets of 250 schemes, as measured smallest to largest by asset value as at 30 September 2024.

Table 2: Scheme distribution on a technical provisions basis as at 30 September 2024

| Funding level | Number of members | Number of schemes | Total assets (£billion) | Total TP liabilities (£billion) | Surplus/deficit (£billion) |

|---|---|---|---|---|---|

| Under 50% | 10,200 | 16 | 2 | 4 | -2 |

| 50% to 55% | 3,482 | 9 | 0 | 0 | 0 |

| 55% to 60% | 34,099 | 14 | 3 | 5 | -2 |

| 60% to 65% | 3,894 | 14 | 0 | 0 | 0 |

| 65% to 70% | 8,865 | 27 | 1 | 1 | 0 |

| 70% to 75% | 34,436 | 31 | 3 | 4 | -1 |

| 75% to 80% | 35,096 | 49 | 4 | 5 | -1 |

| 80% to 85% | 57,554 | 73 | 5 | 6 | -1 |

| 85% to 90% | 124,135 | 112 | 12 | 13 | -2 |

| 90% to 95% | 297,965 | 203 | 42 | 45 | -3 |

| 95% to 100% | 701,480 | 304 | 95 | 97 | -2 |

| 100% to 105% | 846,881 | 441 | 103 | 101 | 3 |

| 105% to 110% | 865,440 | 489 | 120 | 112 | 8 |

| 110% to 115% | 973,334 | 481 | 130 | 115 | 14 |

| 115% to 120% | 784,100 | 394 | 112 | 95 | 17 |

| 120% to 125% | 516,912 | 352 | 81 | 66 | 15 |

| 125% to 130% | 999,125 | 312 | 159 | 126 | 33 |

| 130% to 135% | 339,535 | 252 | 49 | 37 | 12 |

| 135% to 140% | 234,628 | 195 | 28 | 20 | 7 |

| Over 140% | 2,166,534 | 1,050 | 293 | 180 | 113 |

| Total | 9,037,695 | 4,818 | 1,240 | 1,033 | 207 |

Table 3: Schemes distribution on a low dependency basis as at 30 September 2024

| Funding level | Number of members | Number of schemes | Total assets (£billion) | Low dependency liabilities (£billion) | Surplus/deficit (£billion) |

|---|---|---|---|---|---|

| Under 50% | 21,289 | 19 | 2 | 5 | -3 |

| 50% to 55% | 13,247 | 19 | 1 | 2 | -1 |

| 55% to 60% | 4,421 | 14 | 0 | 0 | 0 |

| 60% to 65% | 37,171 | 30 | 3 | 6 | -2 |

| 65% to 70% | 29,879 | 39 | 3 | 4 | -1 |

| 70% to 75% | 55,110 | 54 | 4 | 6 | -2 |

| 75% to 80% | 72,774 | 71 | 6 | 8 | -2 |

| 80% to 85% | 114,424 | 142 | 12 | 15 | -3 |

| 85% to 90% | 231,140 | 185 | 29 | 33 | -4 |

| 90% to 95% | 647,648 | 260 | 84 | 91 | -7 |

| 95% to 100% | 902,987 | 370 | 97 | 100 | -2 |

| 100% to 105% | 1,082,268 | 468 | 137 | 133 | 4 |

| 105% to 110% | 1,425,323 | 470 | 232 | 217 | 15 |

| 110% to 115% | 533,621 | 398 | 76 | 68 | 8 |

| 115% to 120% | 661,604 | 343 | 112 | 96 | 17 |

| 120% to 125% | 743,714 | 332 | 124 | 102 | 22 |

| 125% to 130% | 689,465 | 244 | 61 | 48 | 13 |

| 130% to 135% | 215,065 | 255 | 33 | 25 | 8 |

| 135% to 140% | 455,389 | 183 | 73 | 54 | 19 |

| Over 140% | 1,101,156 | 922 | 150 | 93 | 57 |

| Total | 9,037,695 | 4,818 | 1,240 | 1,103 | 138 |

Table 4: Schemes distribution on a buyout basis as at 30 September 2024

| Funding level | Number of members | Number of schemes | Total assets (£billion) | Total buyout liabilities (£billion) | Surplus/deficit (£billion) |

|---|---|---|---|---|---|

| Under 50% | 63,578 | 57 | 6 | 14 | -8 |

| 50% to 55% | 9,315 | 27 | 1 | 2 | -1 |

| 55% to 60% | 29,284 | 47 | 2 | 4 | -2 |

| 60% to 65% | 58,133 | 70 | 5 | 7 | -3 |

| 65% to 70% | 61,545 | 101 | 5 | 8 | -3 |

| 70% to 75% | 146,215 | 176 | 14 | 19 | -5 |

| 75% to 80% | 254,224 | 237 | 28 | 36 | -8 |

| 80% to 85% | 815,889 | 343 | 100 | 120 | -20 |

| 85% to 90% | 1,377,692 | 434 | 194 | 223 | -29 |

| 90% to 95% | 965,340 | 469 | 128 | 137 | -10 |

| 95% to 100% | 807,156 | 481 | 120 | 123 | -4 |

| 100% to 105% | 763,788 | 430 | 110 | 107 | 3 |

| 105% to 110% | 609,637 | 387 | 76 | 70 | 5 |

| 110% to 115% | 729,619 | 303 | 126 | 112 | 14 |

| 115% to 120% | 465,523 | 261 | 84 | 72 | 12 |

| 120% to 125% | 649,527 | 204 | 71 | 58 | 13 |

| 125% to 130% | 277,205 | 162 | 39 | 31 | 8 |

| 130% to 135% | 137,538 | 127 | 27 | 21 | 7 |

| 135% to 140% | 189,516 | 74 | 23 | 17 | 6 |

| Over 140% | 626,971 | 428 | 80 | 51 | 29 |

| Total | 9,037,695 | 4,818 | 1,240 | 1,233 | 8 |

Source: Roll-forward model v16.4, September 2024 data.

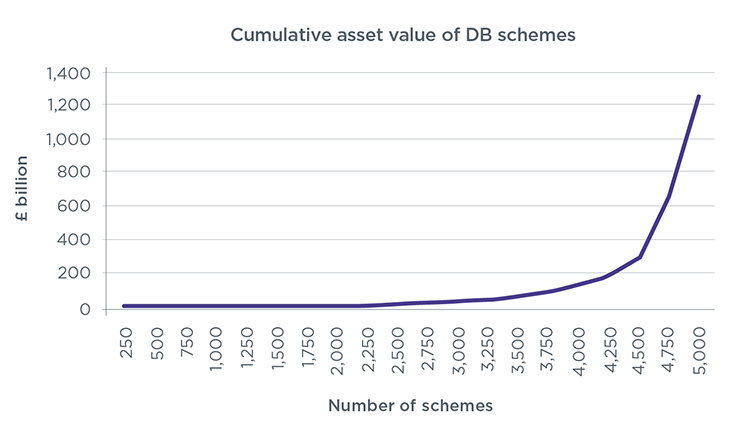

Cumulative assets of all DB schemes

Table 5 and figure 1 show the cumulative assets of all DB schemes from the smallest to the largest as at 30 September 2024.

Table 5

| Number of schemes | Cumulative assets (£bn) as at 30 September 2024 |

|---|---|

| 250 | 0 |

| 500 | 1 |

| 750 | 1 |

| 1,000 | 2 |

| 1,250 | 4 |

| 1,500 | 6 |

| 1,750 | 9 |

| 2,000 | 12 |

| 2,250 | 17 |

| 2,500 | 22 |

| 2,750 | 30 |

| 3,000 | 39 |

| 3,250 | 51 |

| 3,500 | 68 |

| 3,750 | 92 |

| 4,000 | 127 |

| 4,250 | 183 |

| 4,500 | 294 |

| 4,750 | 639 |

| 4,818 | 1,240 |

Figure 1

We have not provided any analysis or commentary regarding the actuarial information provided in this report.

Further details of the data, methodology and limitations are provided in the appendix to this paper.

Appendix

Data

To produce our summary of estimates as at 30 September 2024 we have used the scheme funding data on our systems on 30 September 2024. This data is based on the information provided to us from the 2024 annual scheme return and recovery plan submissions received up to that date.

The raw data and model outputs have been subject to actuarial data checks which look to highlight key outliers and are adjusted as necessary.

We have also used external data sources, these include:

- market indices data obtained from London Stock Exchange Group in order to estimate assets as at 30 September 2024

- Office for National Statistics to provide estimates of benefit outgo and contributions in respect of future accrual

- external consultancies who provide information regarding insurance company (buyouts) pricing

It is important to note the following.

- The underlying data is historical. Schemes have up to 15 months to complete a valuation and need to only undertake a valuation every three years. As such, the liability and asset values held are generally between one year and four years out of date.

- The data is a high-level summary of the results of the valuation, ie we do not have individual member data or detailed benefit structure information that schemes have access to.

- The asset breakdown is based on the last audited accounts over the scheme return year. Schemes have up to seven months from the year end to complete their audited accounts. As such, the asset breakdown is generally around two years out of date.

- When referring to 'schemes' in this report this is in fact referring to individual segregated sections of assets and liabilities: for example the data for this modelling includes 4,818 sections as at September 2024. This report describes these as 'schemes' for simplicity, in line with common use. It should be noted that some of these 'schemes' are sub-sections of a single scheme, so the number of schemes (if defined as separate trusts) is less than this.

Modelling methodology

The figures provided in this report are based on our modelling of the DB universe which estimates the aggregate assets and liabilities as at 30 September 2024 by 'rolling forward' from schemes’ latest actuarial valuations, based on scheme data and relevant financial market information, as set out above. We have applied further actuarial techniques to approximate the low dependency liabilities, as these are currently not provided to TPR.

Given the high level and limited data that we hold, our calculations use broad assumptions and approximations combined with general actuarial methods and techniques. We cannot take account of all scheme-specific characteristics and the actual position of individual schemes will vary, depending on a number of individual factors not covered in our data or methodology.

The key assumptions underlying our model include the following.

- Technical provisions are estimated assuming each scheme uses a 'gilts +' type approach and liability values are adjusted for movements in both fixed interest and index-linked gilt markets to take account of market changes when deriving discount rates and inflation.

- Broadly hedged liabilities are estimated for each scheme by taking the technical provisions results and assumptions reported to us following a scheme’s last valuation, and adjusting them to a basis that assumes:

- a discount rate broadly equivalent to the gilt curve plus 0.5% per annum

- a Retail Price Index (RPI) inflation assumption with no adjustment for an inflation risk premium.

- for Consumer Price Index (CPI) inflation we make a 0.35% per annum deduction to our RPI assumption as a broad approximation of all future pricing differentials for the difference between RPI and CPI

- in addition, if a scheme has a mortality assumption which shows their assumed life expectancies are within the bottom quartile, we uprate the liabilities to allow for a stronger mortality assumption equal to the 25th percentile life expectancy from our universe data

- a broad expense allowance of 3% of liabilities

- Buyout liabilities are estimated based on both movements in the fixed interest and index-linked gilt markets since the date of the last valuation but also for expected changes in the overall premia applied by insurance companies over time.

- Further broad adjustments are made to liabilities for changes in longevity expectations by adjusting the liabilities in line with changes to the core CMI model over the period since a scheme's last valuation.

- Trustees do not take any management action in regards of buying and selling assets or changes to the investment allocation over time.

- Both assets and liabilities are adjusted in line for expected benefit payments paid combined with an adjustment for future accrual, where applicable, over the period since a scheme's last valuation.

- Assets are further adjusted in line with movements in market indices plus deficit repair contributions over the period since a scheme's last valuation.

- Assets are rebalanced daily in order to retain the same investment allocation.

Note that from 31 March 2024, as set out above, an allowance has been applied to both liabilities and asset estimates for both benefit outgo and additional accrual. This is a change in methodology compared to previous models and as such the results in this report are not directly comparable to previous estimates.

There are many more simplifications and approximations in the methods we use to estimate aggregate and individual funding positions, compared with the more robust calculations carried out for formal valuation and recovery plan reporting by scheme actuaries for trustees. Additionally, the greater the magnitude of change in market conditions, the less reliable the simplified method and data will be in illustrating the impact of changing funding levels over time. It should be noted that this is not a TPR-specific issue, but a global actuarial issue when using the approximate ‘roll-forward’ methodology to estimating assets and liabilities at alternative dates.

Furthermore, it should be noted that results are always approximate in nature and while we do not expect a pronounced systemic bias in the model, results may be materially inaccurate at an individual scheme level where experience differs to those of our key assumptions. This could be because of any of the following:

- trustees taking positive management action to change investment strategies, which are not reflected in our current data set due to time lag issues; and/or

- actual asset returns are materially different to index returns or scheme experience materially differs from that assumed.

Caveats and limitations of advice

We are content that the data used in the model is appropriate to provide high-level estimates of the distribution of the DB scheme universe as at 30 September 2024.

As the model has been calculated at an aggregate level, the results should not be used to draw conclusions for individual schemes, nor provide any analysis for scheme funding levels.

Given the narrow scope of the request and that the request seeks to only understand the size and scale of the market distribution, we have not provided any further advice or analysis showing the impact of wider risks and any associated impact of the DB scheme universe. We think that this is proportionate given the scope of the request.

Compliance

This note complies with Technical Actuarial Standard 100 (TAS 100) v2.0, as published by the Financial Reporting Council. TAS 100 v2.0 applies to technical actuarial work (as defined in section 4 of TAS 100 v2.0) that is completed on or after 1 July 2023.