This code of practice applies to activities related to valuations with effective dates on and after 22 September 2024. For activities related to valuations with effective dates before 22 September 2024, refer to the 2014 DB funding code (PDF, 401kb, 51 pages).

- The funding and investment strategy must set out the trustees’ long-term objective and the low dependency funding target they intend the scheme to have achieved, and the investments they intend to hold, at the relevant date.

- A scheme’s relevant date is set by the trustees. Unless the scheme is exempt from these requirements (as described in paragraph 30 of this module), it should be set with reference to significant maturity.

- The scheme actuary is responsible for estimating the date of significant maturity. This estimate must be produced by reference to the ‘duration’ of the scheme’s liabilities.

- A scheme reaches significant maturity when it reaches the duration of its liabilities (measured in years) specified in this code. The specified duration can be found below.

Calculating current and projected duration (maturity) for all schemes (including open schemes)

- Payments in respect of pensions and other benefits will be made from a scheme at different points in time and those payments will have different values. Duration is the weighted mean time until those payments are expected to be made, with the weighting being the discounted value of those payments. Duration is measured in years.

- The payments should include those from insured assets where they are included in the liabilities. We would expect them to be included in the liabilities where the related assets are included and valued in the relevant scheme accounts.

- The scheme actuary should calculate the current and, when needed, projected duration of the scheme.

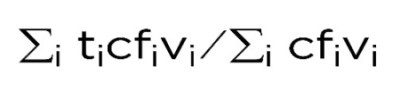

- The calculation of current duration should use the following formula for the Macaulay duration:

Where:

– cfi is the ith projected cashflow

– ti is the (average) time that cfi is expected to be paid

– vi is the discount factor appropriate at time i

– the denominator in the equation is the value of the low dependency liabilities

– the calculation can be rounded to one decimal place

– cashflows can be aggregated into those expected over a period of a year or less

- The calculation of duration must be done using an actuarial basis that is the same as the scheme’s low dependency funding basis, except for economic assumptions which must be chosen by reference to the economic conditions prevailing on 31 March 2023.

- This means for economic assumptions, such as discount rates and inflation (including RPI or CPI), or where assumptions may be inflation-linked, such as those for pension increases, the methodology used should be the same as in the scheme’s low dependency funding basis. For example, where a discount rate is set using an addition to a market-based yield, either implicitly or explicitly, the same addition should be used. For all other assumptions, we would expect them to be the same as in the scheme’s low dependency funding basis.

- We expect that for the first and each subsequent valuation, the scheme takes a consistent approach to this calculation, except when justified by a change in the low dependency assumptions, regulations or the code. We expect the economic assumptions at each valuation will be set based on the economic conditions that applied on 31 March 2023, as if that were the valuation date.

- Except where noted in this code, in the section on determining period to significant maturity for certain schemes, a projected duration, used to determine a future point of significant maturity, should be calculated using the same formula and using the same assumptions as described here. For example, we do not expect the projection needs to allow for the recalculation of duration at future valuations.

Calculating projected duration (maturity): additional guidance for open schemes

- The calculation of duration should be based on liabilities in respect of accrued benefits. However, when projecting what the scheme duration is expected to be in the future, trustees can make an assumption for future accrual and new entrants. Trustees can then allow for any liabilities that would have been earned from accrual at that future time in their projected duration calculations.

- The assumptions used for future accrual and new entrants (when appropriate) must be based on the employer covenant.

- The use of such assumptions will mean that an open scheme can be expected to take longer to reach significant maturity than an equivalent closed scheme. This extra time can be allowed for in the de-risking plan set out in the journey plan, and reflected in the technical provisions’ (TPs) assumptions discussed in the parts of this code on journey planning and technical provisions.

- This means it can be assumed that risk will be taken for a longer time, compared to an equivalent closed scheme. When this is reflected in the discount rates, it will mean that the TPs assumed for an open scheme can be lower than for an equivalent closed scheme of the same maturity.

- Therefore, we would expect trustees to robustly consider how reasonable it is to make allowance for this continued accrual and, where appropriate, new entrants, when projecting the development of the scheme’s duration. We expect the chosen assumptions to be prudent.

- For this reason, we would expect the period of future accrual and, where appropriate, the period where new entrants are assumed to enter the scheme, to be set by reference to the period where the trustees have reasonable certainty over key aspects of covenant such as employer cash flows. Therefore, the reliability period will be a key determinant of this assumption.

- We do recognise that, for most employers, the end of the reliability period is unlikely to be because of a predicted issue with the robustness of the employer. Instead, it reflects a limit in the ability to forecast cash flows with reasonable certainty any further into the future. Where this is the case, and there is an expectation that, in the future, the reliability period is likely to continue to be rolled forward year on year, we would consider it acceptable for the period assumed for future accrual and new entrants to exceed the reliability period by a limited time, with the length of that period reflecting the uncertainty of the cash flows after this period and the additional risk of assuming future accrual and new entrants. However, we would never expect this assumption to exceed the period of covenant longevity and we would usually expect it to be less than this, recognising that accrual and the acceptance of new entrants should cease before an employer can no longer support a scheme.

- In addition to considering the period above, trustees should consider to what extent it is reasonable to assume that the defined benefit (DB) pension will continue to

be offered. In doing so, they should consider, among other elements, contractual entitlements and any statements or commitments made by the employer. Allowing for this issue may reduce the period that it is appropriate to allow for future accrual and, where relevant, new entrants. - The assumptions for new entrants should be evidence-based and prudent. Past experience could be relevant, but the trustees should consider any general trends or plans by the employer. Where allowance is being made for future occurrences that will increase the time to significant maturity (for example an increase in the number of new entrants to the scheme), the trustees should be satisfied that making such an assumption can be justified and is prudent.

Significant maturity

- For the purposes of regulation 4(1)(b) of The Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations 20241 we have the power to set the duration in years which defines when a scheme will reach significant maturity and this can be different for different descriptions of schemes. The duration at which the following descriptions of schemes reach significant maturity is as follows.

- For schemes with no cash balance benefits2, the duration is 10 years.

- For a scheme that only provides cash balance benefits, the duration is eight years.

- For schemes that provide a mix of cash balance and other benefits to which the scheme funding requirements apply, the duration should be the weighted average of the durations described above. The weighting to be applied is that of the relevant liabilities calculated on the basis used to determine duration.

- The estimate of the date on which the scheme is expected to (or, if applicable, did) reach significant maturity must be reviewed every time the funding and investment strategy is reviewed.

- However, where a previously determined relevant date has passed, and the trustees have no reason to believe that the date of significant maturity has materially changed, trustees may choose to instruct the scheme actuary to carry out a broad approximate estimate of the date of significant maturity. In these circumstances, we would not expect any detailed calculations to be carried out to determine this date.

Determining period to significant maturity for certain schemes

- Under the regulations, we have the power to set a date when significant maturity will be reached for different descriptions of schemes.

- To reduce administrative burdens for smaller schemes, trustees of such schemes that submit through the Fast Track submission route can assume that the date the scheme reaches significant maturity is either:

- the date the scheme reaches duration 10 years

- the date set out in the section on time to significant maturity for certain schemes below

- For these purposes, schemes must have a current duration greater than 10 years and smaller schemes are defined to be schemes with 200 members or fewer, excluding members who are eligible for lump sum death benefit only, for hybrid schemes those members with defined contribution (DC) benefits only and fully insured annuitants where they are not included in the calculation of the TP liabilities (as they are not included or valued in the scheme accounts).

Relevant date

- Trustees must determine their relevant date.

- We would not expect the relevant date to be before the effective date of the actuarial valuation to which the funding and investment strategy relates.

- Paragraphs 31 to 34 below do not apply to cash balance sections of collective defined contribution (CDC) schemes with all active members accruing benefits in both sections concurrently, who are exempted from certain regulations in respect of choice of relevant date.

- For schemes that have not passed significant maturity on the effective date of the actuarial valuation to which the funding and investment strategy relates, the relevant date cannot be later than the end of the scheme year in which the scheme reaches significant maturity, though it can be earlier (noting our expectation in paragraph

29 above). - For schemes that have passed significant maturity on the effective date of the actuarial valuation to which the funding and investment strategy relates, the relevant date is the effective date of that valuation.

- When setting the relevant date, trustees should assume that the scheme year will remain as it is at the time the funding and investment strategy is being set or revised.

- Where a scheme has not reached the relevant date, the scheme actuary must estimate the expected maturity of the scheme at the relevant date. If helpful, the actuary may use the maturity as at any date within the scheme year in which the relevant date will fall, as being representative of the maturity as at the relevant date.

Time to significant maturity for certain schemes

- Table 1 can be used to determine the date of significant maturity for certain schemes. It can only be used by schemes who satisfy both of the following criteria:

- The scheme is submitting its valuation through the Fast Track route.

- The scheme has 200 members or fewer, excluding members who are eligible for lump sum death benefit only, for hybrid schemes those members with DC benefits only and fully insured annuitants where they are not included in the calculation of the TP liabilities.

Table 1: Duration and time to significant maturity

| Duration | Time to significant maturity in years |

|---|---|

| 25 | 33 |

| 24 | 32 |

| 23 | 31 |

| 22 | 30 |

| 21 | 29 |

| 20 | 28 |

| 19 | 27 |

| 18 | 25 |

| 17 | 23 |

| 16 | 21 |

| 15 | 18 |

| 14 | 15 |

| 13 | 12 |

| 12 | 8 |

| 11 | 4 |

| 10 | 0 |

- Table 1 above is intended for schemes whose current duration is greater than 10 years. For durations above 25 years add one year to the time to significant maturity of 33 years for each year of increase in duration above 25. For example, a duration of 28 years should have a time to significant maturity of 36 years.

- To determine the date of significant maturity, first, based on the current duration of the scheme calculated in accordance with this code, determine the time to significant maturity from the table above. Then the date of significant maturity is found by adding that time to the effective date of the actuarial valuation to which the funding and investment strategy relates.

- The appropriate time for non-integer durations should be found by interpolation.

Legal references

1 Regulation 4(1)(b) of The Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations 2024 (SI 2024/462) [Regulation 3(1)(b) of The Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations (Northern Ireland) 2024 (SR 2024/90)]

2 Section 51ZB of the Pensions Act 1995 [Article 51ZB of The Pensions (Northern Ireland) Order 1995]