Occupational defined benefit landscape in the UK 2024

This is an official statistics publication produced by The Pensions Regulator (TPR). This annual publication provides an overview of the occupational defined benefit (DB) and hybrid scheme landscape in the UK, reporting on scheme status, membership levels and assets under management.

Published: 11 December 2024

On this page

- Important changes since last year

- Key findings

- Section 1: Number of private schemes

- Section 2: Memberships of private schemes

- Section 3: Technical provisions funding position

- Section 4: Public service DB schemes

- Using this publication

- Glossary

Important changes since last year

For the 2024 release of this publication, the actuarial methodology for rolling forward assets and liabilities for private DB and hybrid schemes has been amended to make allowance for benefit outflow (eg pensions, lump sums, transfer values) and future benefit accrual (and the associated contributions in respect of this accrual). The change impacts both the total assets and liabilities but has negligible impact on the overall funding level. As such, assets and liabilities values should not be compared to previous versions of the DB Landscape. To make comparisons between 2024 and 2023, we have restated 2023 values on the amended methodology in this 2024 publication.

Please see Methodology section at the end of this publication for more details.

To improve readability of this publication, some data tables have been moved to the accompanying annex. Please refer to the annex available on the right-hand side of the page for the underlying data for any graphs or figures.

Key findings

- As with previous years, the DB and hybrid landscape continues to shrink at a yearly rate of 3% on average. The number of schemes reduced from 7,300 in 2012 to 5,190 in 2024. Schemes continue to close, with the percentage closed to future accrual (excluding those in wind-up) rising from 72% in 2023 to 73% in 2024.

- Membership in private DB and hybrid schemes has fallen by 2% since 2023 to 9,424,000. Only 12% of memberships are in open schemes.

- The funding level has remained broadly similar to that in 2023, increasing to 118% in 2024 from 117% in 2023. This is a result of small reductions in both the amount of assets (4%) and technical provision (TP) liabilities (5%) since 2023. The percentage of schemes in TP surplus is 80% in 2024 compared to 77% in 2023.

Section 1: Number of private schemes

This section examines the number of DB schemes in 2024, including time series data and segmentation by scheme status.

Scheme status describes the position of a scheme’s lifecycle from starting up to final closure. The statuses in this release are split between the following.

- Open schemes, where new members can join the DB section of the scheme and accrue benefits.

- Schemes closed to new members (CTNM), in which existing members can continue to accrue benefits but no new members can join.

- Schemes closed to future accruals (CTFA), where existing members can no longer accrue new years of service and no new members can join.

- Schemes that are in the process of winding up as notified to TPR.

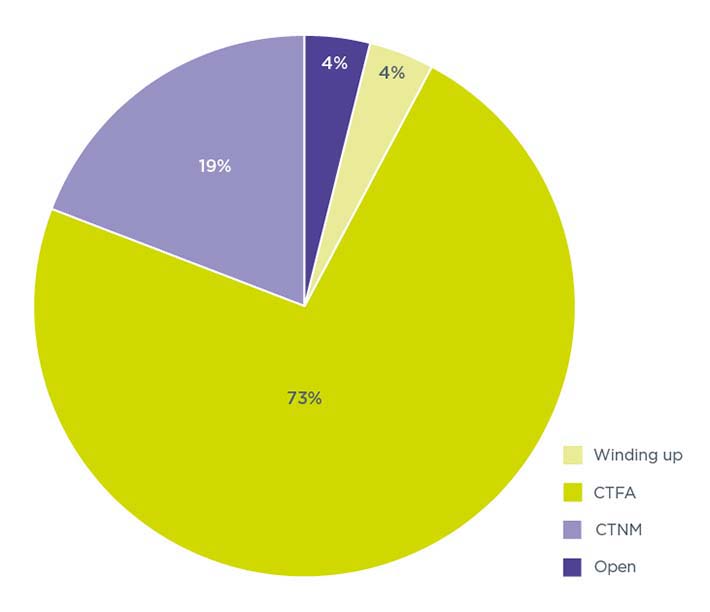

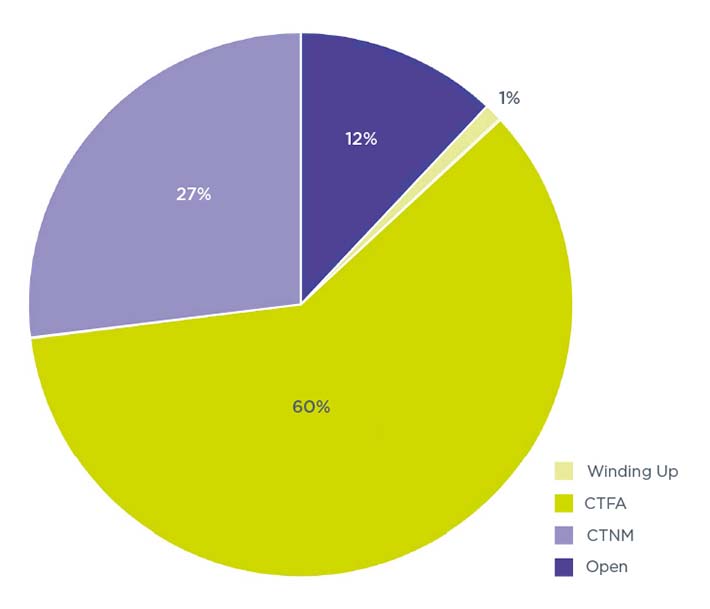

Figure 1.1: Distribution of schemes by status

Figure 1.1 illustrates the lifecycle of schemes, transitioning from open, to CTNM, to CTFA, and eventually to winding up. The majority (73%) are in the CTFA category.

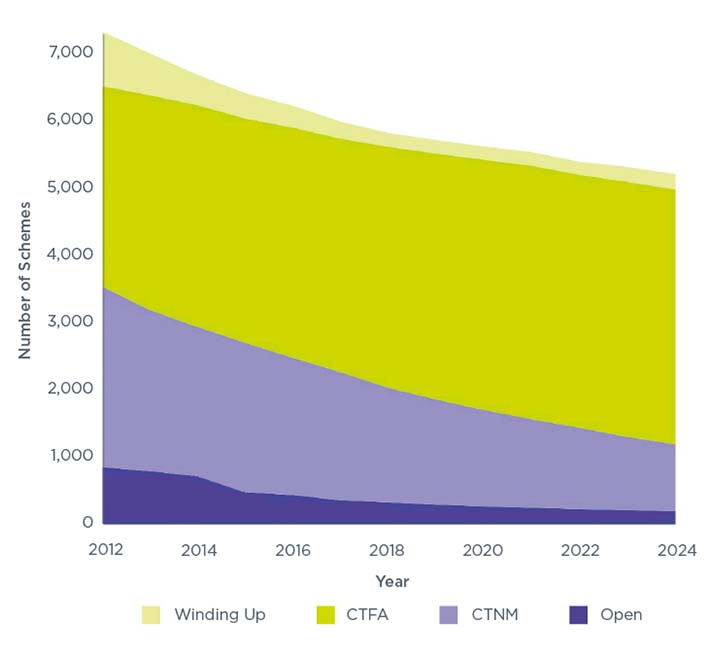

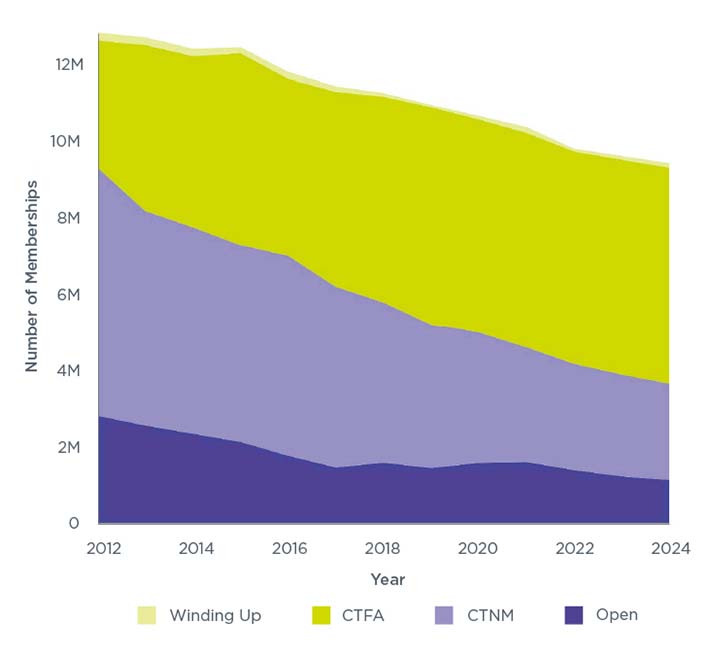

Figure 1.2: Distribution of schemes by status and year

Figure 1.2 shows a yearly decline of 3% in average from the total number of schemes, from 7,300 in 2012 to 5,190 schemes remaining today. Notably, the number of CTNM schemes has decreased rapidly, alongside winding up and open schemes. In contrast, the CTFA category is the only one to show a consistent increase.

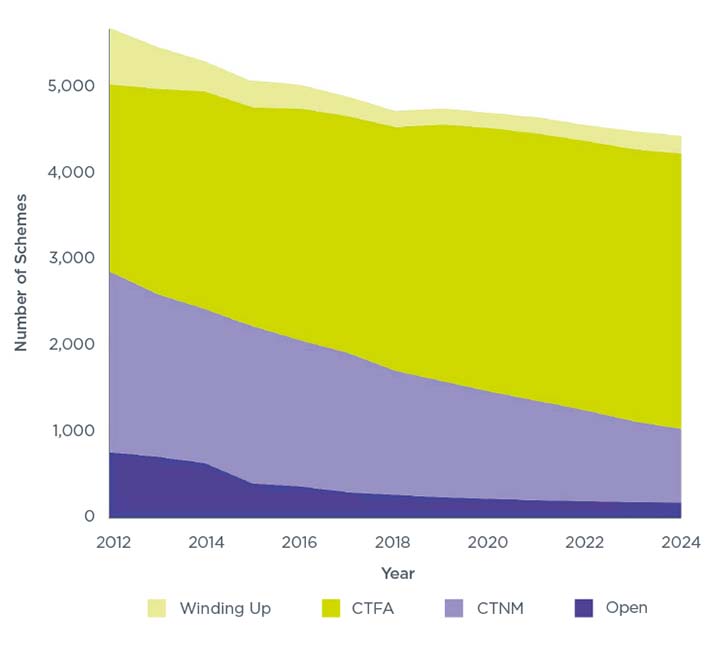

Figure 1.3: Scheme status by year excluding hybrid schemes

Figure 1.3 reflects that there are minimal changes in status distributions in 2024. The percentage of schemes closed to future accrual (excluding those in wind-up) has risen from 72% in 2023 to 73% in 2024.

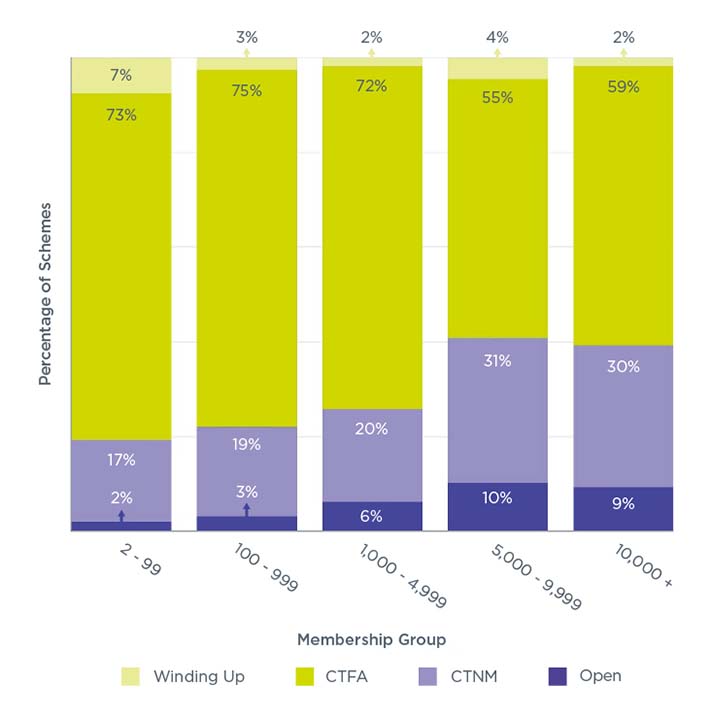

Figure 1.4: Distribution of schemes by status and membership group

Figure 1.4 displays how scheme size and status are related, with a noticeable trend of larger schemes being more likely to remain open, while smaller schemes often tend to be categorised as CTFA. It is important to consider the actual numbers rather than just the percentages (refer to Figure 1.4 Table 1 in the annex), as there are significantly fewer schemes in the D: 5,000 - 9,999 and E: 10,000 + categories, with 170 schemes each, representing just a 6% each of the total number of schemes.

Table 1.5: Proportion of schemes by status and principal employer type (% by status)

| Principal employer type | A: Open | B: CTNM | C: CTFA | D: Winding up | Total |

|---|---|---|---|---|---|

| College or education institution | 28% | 28% | 40% | 4% | 100% |

| Government / public body | 9% | 0% | 91% | 0% | 100% |

| Limited liability partnership | 0% | 2% | 95% | 3% | 100% |

| Other | 10% | 21% | 66% | 3% | 100% |

| Overseas company | 0% | 15% | 79% | 5% | 100% |

| Partnership | 0% | 7% | 89% | 4% | 100% |

| Private limited company | 1% | 17% | 80% | 3% | 100% |

| Public limited company | 1% | 20% | 75% | 4% | 100% |

| Registered charity | 3% | 17% | 78% | 2% | 100% |

| Sole trader | 0% | 33% | 67% | 0% | 100% |

Table 1.5 outlines the status distribution for each employer type. Overall, there are more schemes in the CTFA category across all employer types. The employer with the lowest percentage in this category is college or education institution, where 28% of schemes are open, 28% are CTNM, 40% are CTFA, and 4% are winding up. The employer type with the highest in CTFA is Limited liability partnership.

Table 1.6: Proportion of schemes by principal employer type and status (% by employer type)

| Principal employer type | A: Open | B: CTNM | C: CTFA | D: Winding up |

|---|---|---|---|---|

| College or education institution | 14% | 2% | 1% | 2% |

| Government / public body | 1% | 0% | 0% | 0% |

| Limited liability partnership | 0% | 0% | 2% | 2% |

| Other | 42% | 12% | 8% | 10% |

| Overseas company | 0% | 1% | 1% | 2% |

| Partnership | 0% | 0% | 1% | 1% |

| Private limited company | 32% | 69% | 73% | 69% |

| Public limited company | 2% | 10% | 8% | 12% |

| Registered charity | 8% | 6% | 6% | 4% |

| Sole trader | 0% | 0% | 0% | 0% |

| Total | 100% | 100% | 100% | 100% |

Table 1.6 shows which employer types have the most schemes in each status category. Private limited companies account for the largest share across all categories, ranging from 32% to 73%. 'Other' employer types rank as the second largest contributor.

Section 2: Memberships of private schemes

This section examines the number of memberships in DB schemes, including time series data and segmentation by scheme status.

Figure 2.1: Distribution of membership by status

Figure 2.1 displays the distribution of private scheme membership by scheme status, with 60% CTFA, 27% CTNM, 12% open and 1% winding up.

Figure 2.2: Distribution of membership by status and year

Figure 2.2 shows a decline in the total number of memberships over the years, with 9,424,000 memberships remaining today (a decrease of 2% since 2023). The CTFA category presents a consistent increase along the years, with only 12% of memberships remaining in open schemes.

Table 2.3: Number of memberships by status and membership type

| Status | Active | Deferred | Pensioner |

|---|---|---|---|

| A: Open | 424,000 | 434,000 | 261,000 |

| B: CTNM | 237,000 | 927,000 | 1,349,000 |

| C: CTFA | 0 | 3,015,000 | 2,641,000 |

| D: Winding up | 0 | 62,000 | 74,000 |

| Total | 661,000 | 4,438,000 | 4,325,000 |

Table 2.3 shows the biggest number of pensioner and deferred memberships belongs to CTFA schemes with 3,015,000 and 2,641,000.

Table 2.4: Number of memberships by membership group and membership type

| Membership group | Active | Deferred | Pensioner |

|---|---|---|---|

| A: 2 to 99 | 2,000 | 35,000 | 46,000 |

| B: 100 to 999 | 25,000 | 364,000 | 376,000 |

| C: 1,000 to 4,999 | 68,000 | 730,000 | 714,000 |

| D: 5,000 to 9,999 | 78,000 | 491,000 | 535,000 |

| E: 10,000 + | 487,000 | 2,817,000 | 2,655,000 |

| Total | 660,000 | 4,437,000 | 4,326,000 |

In table 2.4 it can be seen that the majority of memberships are in very large schemes with: 74% of active memberships, 63% of deferred memberships and 61% of pensioner memberships in schemes with more than 10,000 memberships.

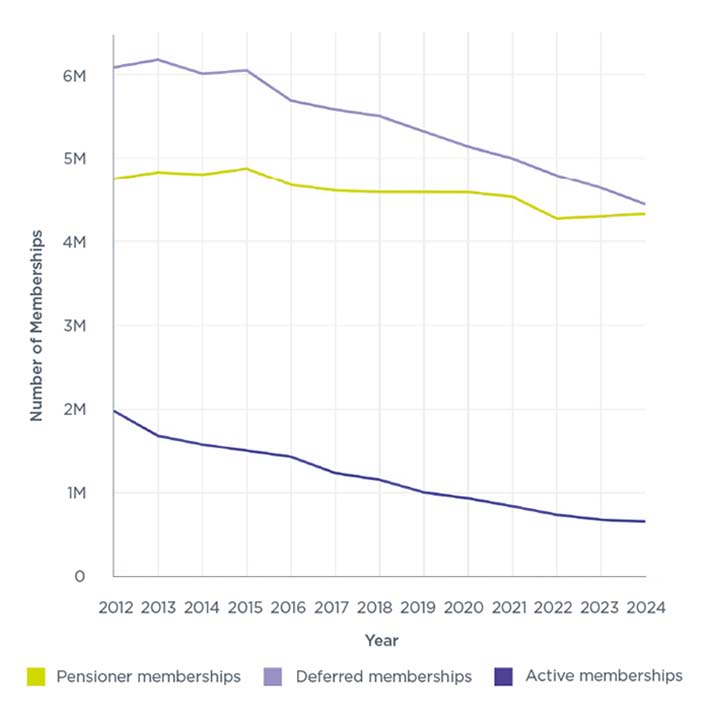

Figure 2.5: Membership by type and year

Figure 2.5 shows a decline in deferred memberships from 6,082,000 in 2012 to 4,437,000 in 2024. Pensioner memberships increased over the last two years, from 4,267,000 in 2022 to 4,325,000 in 2024. Finally, the number of active memberships has been decreasing slowly but constantly, with a total number of 661,000 in 2024.

Table 2.6: Proportion of membership by status and principal employer type (% by status)

| Principal employer type | A: Open | B: CTNM | C: CTFA | D: Winding up | Total |

|---|---|---|---|---|---|

| College or education institution | 69% | 23% | 8% | 0% | 100% |

| Government / public body | 0% | 0% | 100% | 0% | 100% |

| Limited liability partnership | 0% | 1% | 98% | 0% | 100% |

| Other | 20% | 26% | 54% | 1% | 100% |

| Overseas company | 0% | 9% | 88% | 3% | 100% |

| Partnership | 0% | 34% | 66% | 0% | 100% |

| Private limited company | 17% | 23% | 59% | 2% | 100% |

| Public limited company | 1% | 27% | 71% | 1% | 100% |

| Registered charity | 20% | 14% | 66% | 0% | 100% |

| Sole trader | 0% | 6% | 94% | 0% | 100% |

Table 2.6 displays the distribution of membership by status and employer types. Education institutions have most of their memberships in open schemes, while most of the other employer’s membership belong to CTFA schemes.

Table 2.7: Proportion of membership by principal employer type and status (% by employer type)

| Principal employer type | A: Open | B: CTNM | C: CTFA | D: Winding up |

|---|---|---|---|---|

| College or education institution | 15% | 3% | 0% | 0% |

| Government / public body | 0% | 0% | 1% | 0% |

| Limited liability partnership | 0% | 0% | 1% | 0% |

| Other | 10% | 7% | 6% | 4% |

| Overseas company | 0% | 0% | 0% | 1% |

| Partnership | 0% | 0% | 0% | 0% |

| Private limited company | 70% | 50% | 51% | 65% |

| Public limited company | 2% | 39% | 39% | 29% |

| Registered charity | 3% | 1% | 2% | 0% |

| Sole trader | 0% | 0% | 0% | 0% |

| Total | 100% | 100% | 100% | 100% |

Table 2.7 shows which employer types have the most memberships in each status category. Overall, private limited company accounts for the biggest number of memberships in each category, with values ranging from 50% to 70%.

Section 3: Technical provisions funding position

This section examines technical provisions funding positions, including assets, technical provisions liabilities and surplus (or deficit) across different variables as status and membership group.

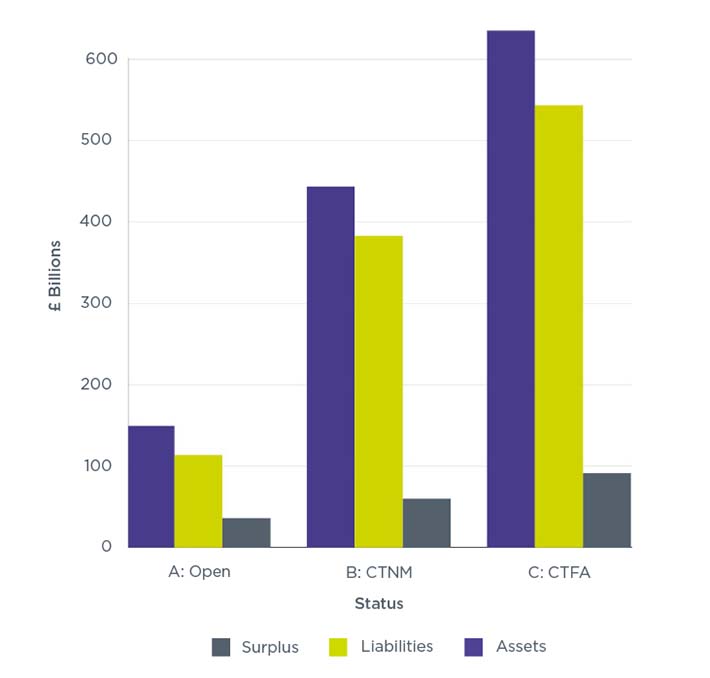

Figure 3.1: Estimated technical provisions funding figures as at 31 March 2024 for schemes in surplus and deficit by scheme status (excludes schemes winding up)

Figure 3.1 presents the estimated technical provisions funding figures, including estimated assets, liabilities, and surplus, for open, CTNM, and CTFA schemes. The CTFA schemes hold the largest amount of assets, totalling £635 billion. In comparison, CTNM schemes have £444 billion in assets, while open schemes possess £150 billion.

Data for Figure 3.1: Estimated funding figures as at 31 March 2024 for schemes in surplus and deficit by scheme status (excludes schemes winding up)

| Status | Assets (£bn) | Technical provisions liabilities (£bn) | Surplus (Deficit) (£bn) |

|---|---|---|---|

| A: Open | 149.623 | 113.796 | 35.827 |

| B: CTNM | 443.506 | 383.167 | 60.339 |

| C: CTFA | 634.822 | 543.320 | 91.502 |

| Total | 1,227.951 | 1,040.283 | 187.668 |

| Total (2023) | 1,281.295 | 1,094.530 | 186.765 |

Data for figure 3.1 shows that total assets have reduced from £1,281 billion in 2023 to £1,228 billion in 2024 (a 4% reduction) in 2023. TP liabilities have reduced from £1,095 billion to £1,040 billion in 2024 (a 5% reduction). This means the funding level has stayed broadly the same moving to 118% in 2024 from 117% in 2023.

Table 3.2: Estimated funding figures as at 31 March 2024 for schemes in deficit by status (excludes schemes winding up) with a comparison to overall total for 31 March 2023

| Status | Assets (£bn) | Technical provisions liabilities (£bn) | Surplus (Deficit) (£bn) |

|---|---|---|---|

| A: Open | 1.815 | 2.036 | -0.221 |

| B: CTNM | 101.947 | 110.356 | -8.41 |

| C: CTFA | 88.308 | 98.14 | -9.832 |

| Total | 192.07 | 210.533 | -18.463 |

| Total (2023) | 221.828 | 250.615 | -28.786 |

Table 3.3: Estimated funding figures as at 31 March 2024 for schemes in surplus by status (excludes schemes winding up) with a comparison to overall total for 31 March 2023

| Status | Assets (£bn) | Technical provisions liabilities (£bn) | Surplus (Deficit) (£bn) |

|---|---|---|---|

| A: Open | 147.808 | 111.76 | 36.048 |

| B: CTNM | 341.559 | 272.811 | 68.748 |

| C: CTFA | 546.514 | 445.18 | 101.334 |

| Total | 1,035.88 | 829.75 | 206.131 |

| Total (2023) | 1,059.47 | 843.915 | 215.551 |

Table 3.4: Number of schemes by estimated funding level as at 31 March 2024 and status (excludes schemes winding up) with a comparison to overall total for 31 March 2023

** – count suppressed. Any counts less than 5 are suppressed.

| Status | Less than 60% | 60% to less than 80% | 80% to less than 100% | 100% or greater | Total |

|---|---|---|---|---|---|

| A: Open | ** | ** | 10 | 170 | 180 |

| B: CTNM | ** | 10 | 130 | 840 | 980 |

| C: CTFA | 40 | 140 | 620 | 2,900 | 3,700 |

| Total | 40 | 160 | 760 | 3,910 | 4,870 |

| Total (2023) | 90 | 180 | 860 | 3,770 | 4,900 |

Table 3.4 shows that 3,910 schemes have 100% or greater funding in 2024. The percentage of schemes in technical provision surplus is therefore 80% in 2024, compared to 77% in 2023.

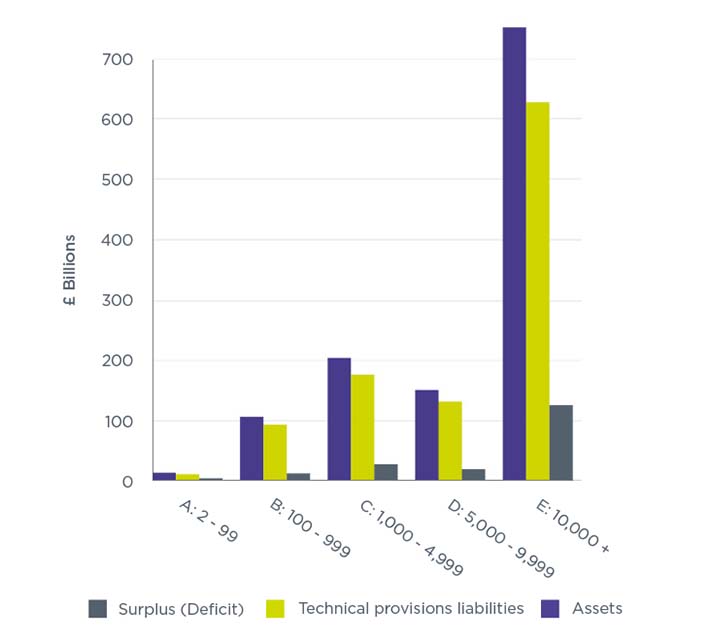

Figure 3.5: Estimated technical provisions funding figures as at 31 March 2024 by membership group (excludes schemes winding up)

Figure 3.5 shows a high number of assets, technical provisions liabilities and surplus for the schemes in the group E:10,000 + with a total of £753 billion in assets, surpassing by a considerable amount the other groups which all combined just reach up to £475 billion in assets.

Table 3.6: Number of schemes by membership group and estimated funding level group (by technical provisions) as at 31 March 2024 (excludes schemes winding up) with a comparison to overall total for 31 March 2023

** – count suppressed. Any counts less than 5 are suppressed.

| Membership group | Less than 60% | 60% to less than 80% | 80% to less than 100% | 100% or greater | Total |

|---|---|---|---|---|---|

| A: 2 to 99 | 20 | 50 | 190 | 1,530 | 1,790 |

| B: 100 to 999 | 20 | 80 | 380 | 1,630 | 2,110 |

| C: 1,000 to 4,999 | ** | 20 | 130 | 500 | 650 |

| D: 5,000 to 9,999 | ** | ** | 30 | 110 | 140 |

| E: 10,000 + | ** | ** | 20 | 140 | 160 |

| Total | 40 | 150 | 760 | 3,910 | 4,860 |

| Total (2023) | 90 | 180 | 860 | 3,770 | 4,900 |

Section 4: Public service DB schemes

Section 4 examines the status of public service DB schemes in the 2024 regarding memberships and status.

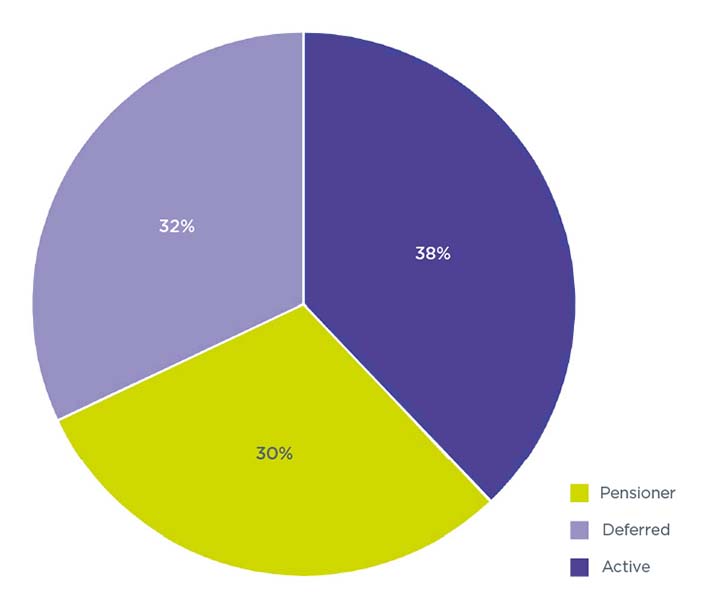

Figure 4.1: Balance of membership types in public service schemes

The pie chart outlines a balance in between the category of memberships. A total of 38% are active, 32% deferred and 30% pensioner.

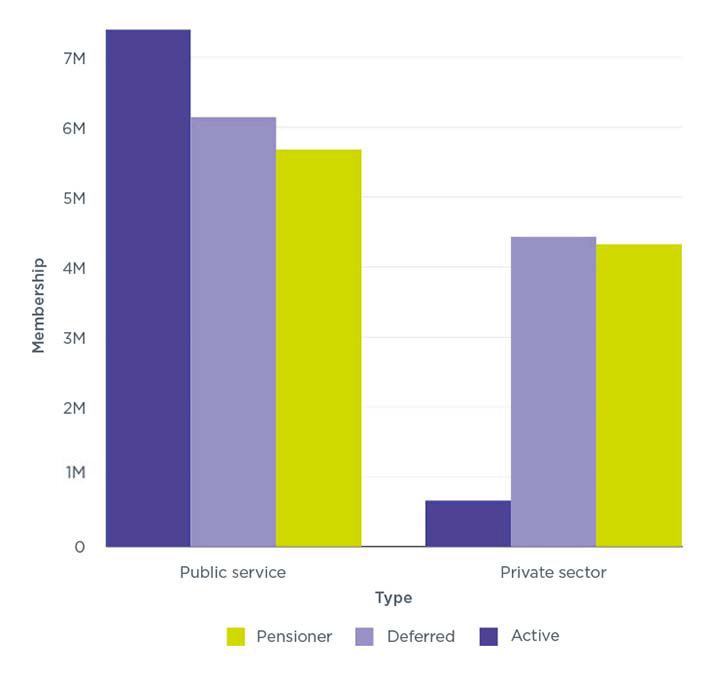

Figure 4.2: Comparison of balance of membership types – public service and private DB/hybrid

Figure 4.2 shows there are in total 8,056,000 active DB memberships, 92% belong to the public service. There are 10,579,000 deferred memberships, with 58% of them in the public service and 42% in the private sector. Finally, there are 10,011,000 pensioner memberships, with 57% of them belonging to the public service and 43% to the private sector.

Using this publication

Data sources

The data used to produce our official statistics is collected from all occupational DB and hybrid schemes, via our DB and hybrid scheme returns. This publication uses data held by us as at 31 March 2024. Schemes are required to submit their returns by 31 March annually. For membership statistics, the data relates to the scheme’s effective date, which falls in the 2022/2023 financial year.

The scheme return includes private and public service DB and hybrid schemes. Private schemes in scope have more than one member that are eligible for the (PPF) and/or are subject to the Pensions Act 2004 Part 3 scheme specific funding regime as of 31 March 2024 and/or are in the process of winding up.

There are 5,190 private schemes in scope. Where a scheme is sectionalised or segregated, each section is treated as if it were a separate scheme for this report.

There are 21 public service pension schemes in scope. We treat each of the locally administered sections as a separate scheme and therefore regard the public service landscape as having 204 schemes.

Statistics for 'technical provisions funding' only covers 94% of the entire private scheme population. Schemes excluded are not required to submit technical provisions funding valuations as they meet one of the following criteria.

- They are in the process of winding up.

- They are not yet liable to submit a technical provisions valuation.

- Data required for funding calculations is missing.

This publication is not directly comparable with the PPF’s Purple Book, which includes only those schemes eligible for the PPF.

Please note that individuals may have multiple pension entitlements spread over multiple schemes, so they may be included more than once in 'membership' counts.

Methodology

These statistics report on administrative data and actuarial data derived from it. Accuracy is addressed by eliminating data errors as far as possible. Potential sources of error include the following.

- Schemes entering data incorrectly as part of their scheme return.

- Mistakes in the programming code used to analyse the data and produce the statistics, and by analysts interpreting the data incorrectly.

Throughout this publication we have rounded scheme numbers to the nearest 10, memberships to the nearest 1,000, financial figures to the nearest million, and percentage figures to 0 decimal places. For this reason, the sum of figures may not equate to the total values.

Technical provisions funding position

The funding figures in this publication represent estimated assets and technical provisions liabilities of private sector occupational DB schemes, using standard actuarial techniques to adjust both assets and liabilities from their most recent actuarial valuation to a common date of 31 March 2024.

An actuarial or funding valuation is a calculation made by an actuary of the assets needed for the scheme to meet its statutory funding objective. These include pensions in payment (including those payable to survivors of former members) and benefits accrued by other members and beneficiaries, which will become payable in the future.

Our actuarial team has estimated changes in the amount of liabilities for individual schemes between their latest valuation date (as reported by the trustees in their scheme return or recovery plan submission) and a common date using an internal model. This is done by tracking changes in fixed interest and index-linked gilt yields and the annual Continuous Mortality Investigation (CMI) mortality projections analysis with further adjustment in respect of assumed future accrual and benefit payments made over this inter-valuation period.

It measures the corresponding changes in asset positions by tracking the performance of the relevant financial indices (based on the asset allocations as reported by the trustees in their latest scheme return) and further adjustment for the assumed contributions in relation to future accrual, benefit payments and deficit repair contributions made over this inter-valuation period.

The model tracks the effect of changed market conditions between these two dates on a consistent basis for all schemes. This basis is reviewed regularly. It does not consider any other changes to a scheme’s asset and liability profile due to scheme-specific experience, demographic changes (excluding changes to the underlying CMI mortality projections model), curtailments, settlements, changes in asset strategy (the model assumes the latest scheme return asset allocations apply over the whole of the inter-valuation period), scheme-specific investment performance, contingent assets, or covenant support. In particular, the change in liability-driven investment values over 2022 may not be fully recognised in the model.

Scheme status data validation

There are four ordered validation steps applied to private sector DB and hybrid scheme statuses:

- Step 1: for mixed hybrid schemes that have identified that they will not accept new members who would accrue a DB entitlement, we have adjusted the status to 'closed to new members'.

- Step 2: where a scheme states they are open or closed to new members but have no active DB members and no active liabilities, the status is adjusted to 'closed to future accruals'.

- Step 3: where a scheme states it is closed to future accrual but has active DB members and active liabilities, the status is adjusted to 'closed to new members'.

- Step 4: where a scheme states it is open but has had declining total membership over the previous three years, the status is adjusted to 'closed to new members'.

In all other cases, statuses are taken to be as submitted by the scheme. 1,469 schemes have had their status changed as part of the validation methodology.

For schemes that are classified as closed to future accrual, any memberships classified as 'active' have been reclassified as 'deferred'. This impacts 69,578 memberships.

Changes in 2024

The actuarial roll forward model estimates the funding position, assets, and liabilities for the whole of the DB universe at specific dates, using the raw valuation data from schemes referencing different valuation dates. In 2024, the model has been adjusted to make allowance for benefit outflow (eg pensions, lump sums, transfer values) and future benefit accrual (and the associated contributions in respect of this accrual). Historically, these effects were excluded because the net effect of excluding these items on funding levels (eg ratio of assets to liabilities) is negligible (although it will impact the notional values of both assets and liabilities).

This change is consistent with our recent publications, including the DB funding code, which was published in July 2024.

In addition, for this year the funding values as at 31 March 2023 have been re-calculated using this revised methodology using data held by TPR on 30 September 2023. This change will only impact 2023 calculations and is part of the transition process to the new methodology.

The impact on 2023 values is as follows:

| Funding figures | 2023 Values with 2023 methodology | 2023 Values with 2024 methodology | Difference |

|---|---|---|---|

| Assets (£bn) | 1,415.503 | 1,281.295 | -134.208 |

| TP liabilities (£bn) | 1,236.188 | 1,094.530 | -141.658 |

| Funding level | 115% | 117% | +2pp |

| Percentage of schemes in TP surplus | 74% | 77% | +3pp |

Further detail on these changes and the differences in methodology approaches are included in the joint statement from TPR, ONS and PPF regarding our estimates.

Contact

If you have a specific enquiry about our DB and hybrid schemes 2024 Official Statistics, please contact: evidenceandinsight@tpr.gov.uk.

Glossary

Accrual

Accrual is the build-up of an active scheme member’s pension benefits or entitlements in a DB pension scheme.

Active members

In a DB scheme, these are members of the scheme who are current employees and accruing benefits.

Actuarial or funding valuation

A comparison by the actuary of the value placed on scheme assets with the technical provisions and an assessment of any future contribution requirement. Calculating the technical provisions is usually based on full member-by-member data.

Closed to future accrual

Where existing members can no longer accrue new years of service and no new members can join.

Closed to new members

Schemes in which existing members continue to accrue benefits but no new members can join.

Deferred members

Deferred members are members of pension schemes who have accrued rights to pensions that will come into payment in the future but who are no longer accruing benefits in the scheme. Also known as members with preserved pension entitlements.

Defined benefit (DB)

A defined benefit (DB) pension is one in which the rules of the scheme specify the rate of benefits to be paid. The most common DB scheme is a final salary scheme in which the benefits are based on the number of years of pensionable service, the accrual rate and the final salary. An alternative to the final salary scheme is the Career Average Revalued Earnings (CARE) scheme, which is also a DB scheme.

Effective date (valuation date)

An actuarial valuation or an actuarial report considers the funding of a scheme as at a particular date, known as the effective date. The effective date will be earlier than the date on which calculations are done. The effective date of a scheme’s first Technical Provisions valuation cannot be before 22 September 2005.

Funded (or unfunded) scheme

A funded scheme is one in which benefits are met from a fund built up in advance from contributions and investment income. Such schemes have assets, even if these are not sufficient to meet all their liabilities, by contrast with unfunded schemes, in which liabilities are not underpinned by assets.

Hybrid scheme

A hybrid scheme is an occupational pension scheme where members have either a choice, or mixture, of DB and DC pension entitlements. In a ‘pure’ hybrid arrangement, members receive benefits that are a mixture of DB and DC. In a ‘mixed hybrid’ scheme, there are separate DB and DC groups of members (often organised in separate sections of the scheme).

Occupational pension schemes

An occupational pension scheme is an arrangement (other than accident or permanent health insurance) organised by an employer (or on behalf of a group of employers) to provide benefits for employees on their retirement and for their dependents on their death. They are a form of workplace pension. Occupational pension schemes for private sector employees are also referred to as trust-based schemes.

Open

Where new members can join the DB section of the scheme and accrue benefits.

Pensioner members

Pensioner members are members of pension schemes who are receiving pensions or income withdrawals, sometimes known as beneficiaries.

Pension Protection Fund (PPF)

A corporate body established under the Pensions Act 2004. The PPF was set up to provide compensation to members of eligible DB pension schemes, when there is a qualifying failure event in relation to the employer, and where there are insufficient assets in the pension scheme to cover the PPF level of compensation.

Public service pension schemes

These are pension schemes within the meaning defined in Section 318 of the Pensions Act 2004. These are schemes established under the Public Service Pensions Act 2013 Act, new public body pension schemes and other statutory pension schemes which are connected to those schemes. It does not apply to schemes in the wider public sector, or any scheme that is excluded from being a public service pension scheme within the meaning of the Pensions Act 2004. Substantially, these are the schemes providing pension benefits for civil servants, the judiciary, local government workers, teachers, health service workers, fire and rescue workers, members of police forces and the armed forces. This includes unfunded pension schemes.

Schemes Winding up

Schemes winding up are defined as such if previously informed to TPR via Exchange. For more information please see Winding up your DB scheme.

Technical provisions

These are the liabilities or funding measure used for the purposes of technical provisions valuations (see below). The technical provisions are a calculation undertaken by the actuary of the assets needed at any particular time to make provision for benefits already considered accrued under the scheme using assumptions prudently chosen by the trustees – in other words, what is required for the scheme to meet the statutory funding objective. These include pensions in payment (including those payable to survivors of former members) and benefits accrued by other members and beneficiaries, which will become payable in the future.

Technical provisions valuation or scheme funding valuation

This is an actuarial valuation meeting the requirements of Part 3 of the Pensions Act 2004 concerning the funding of DB pension liabilities, which apply to any actuarial valuation received by trustees (on or after 30 December 2005) that is based on an effective date of 22 September 2005 or later.